Stocks cratered to a 17-year low despite the $1 trillion deficit. The old tricks aren’t working.

U.S. equity markets plunged in the opening minutes of trading, gutting a rebound on Monday.

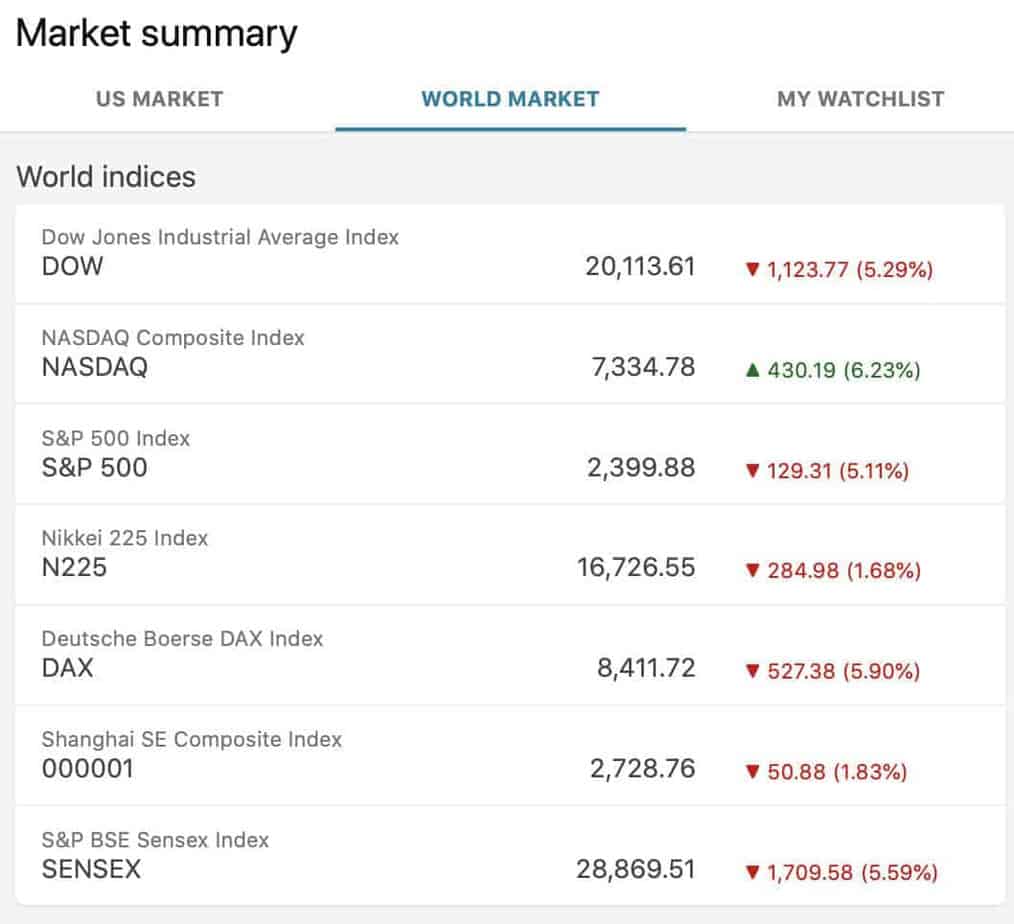

The Dow Jones Industrial Average fell 1,268 points, or 5.9 percent, while the S&P 500 and Nasdaq Composite were lower by 5.4 percent and 5.5 percent, respectively. Trading is halted if the S&P 500 falls by 7 percent.

The early selling comes as the Trump administration and Congress hammer out the details of a $1 trillion stimulus package.

Boeing shares were rocked as the company called for a $60 billion bailout for aerospace manufacturers.

Airlines, restaurants, hotels and casino operators remained under pressure as the Trump administration weighs assistance for the industries hit hardest by the pandemic.

Meanwhile, plunging oil prices hammered energy giants ExxonMobil and Chevron and weighed heavily on Hess Corp. and Continental Resources. West Texas Intermediate crude oil was down 8.1 percent at $25.10 a barrel, its lowest in 17 years.

Russia and Saudi Arabia decided this was the time to start an oil war to destroy U.S. shale.

Elsewhere, the yield curve steepened as buyers crowded into shorter-dated Treasurys and sold longer ones. The yield on the 2-year note was down 4.1 basis points at 0.42 percent while the yield on the 10-year note was up 7.1 basis points at 1.067 percent.

The steeper curve was unable to give relief to banks, which continued to see their share prices sink.

Few winners in this market.

Lesson to be learned here, don’t do that with our (taxpayers’) money. Another lesson is you don’t loose if you don’t sell and ride it out instead. The market will come roaring back. But there are those who are forced to loose. They’re the ones with IRAs and 401Ks who have reached the age of 70 or so and the… Read more »

Roller coasters gonna rolla. It’s a good thing that we have a NYC brawler at the helm for these wild and crazy times. Having someone deluded about a neo-feudal serf plantation globocorp utopia would be disastrous at this point in time. Educated derelicts with delusions about a rainbow utopia world where all comrades just get along and enjoy dollar store… Read more »