We warned about the Corporate Transparency Act in January. The Act passed in 2021 but is in effect now. It has many exemptions, except for small businesses.

Under the premise that they want to catch criminals and terrorists who use corporations and LLCs to conduct illegal activities, the government has imposed more regulations and rules on US companies.

Business entities are being singled out over all of the many things criminals use to commit their crimes.

The act goes after small businesses, not Goldman Sachs, Black Lives Matter, and Facebook, but small businesses.

One requirement is that small business owners file a new report to the federal government every year to disclose the company’s shareholders. They already have to do that for the IRS, so this is double work for them. They also have to report to the Financial Crimes Enforcement Network, otherwise known as FinCEN, as if they were criminals.

It has over 100 pages of regulations. Even if the business owner makes a mistake, they could be fined daily, owe $10,000, and go to prison for two years.

Business owner’s personal information is reported.

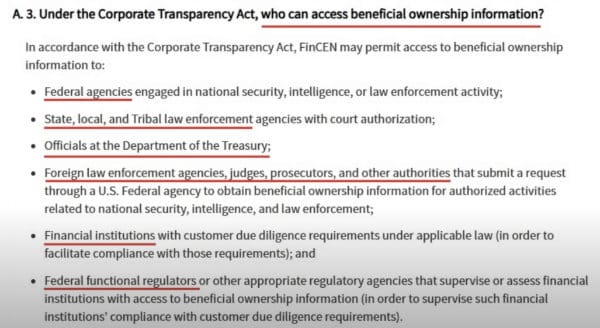

Who can ask for the information? A lot of people, even foreigners!

The private sector is under attack.

Government seeks to be the only employer. Corral the “workers”…

You nailed it!

If you know anyone who owns a small business, you may want to clue them in. Many are unaware of this new law. I know because I’ve spoken to a few of them. Is the federal government advising them or will they learn about it by getting massive fines next year? This will surely discourage anyone from starting a new… Read more »