Are Illinois Democrats Looking to Buy Votes?

By Mark Schwendau

As Illinois Governor J.B. Pritzker and other Democrats are in trouble this election cycle, several unusual moves are made by the Democrat politicians who lead this blue state. Their first move was the 2022 State of Illinois Tax Rebates. Imagine the surprise on many Illinoisans’ faces when they wound up getting an unexpected small check from the Illinois State Treasurer, having absolutely no idea what it was for since they no longer follow the biased liberal news sources. The “Illinois Family Relief Plan” offered a rebate-style check based on your income and real estate taxes assuming you were employed and owning a home in Illinois.

Several conditions apply to receive a check from the Illinois Treasurer. You had to be an Illinois resident in 2021, and your adjusted gross income on your 2021 Form IL-1040 had to be under $400,000 (if filing jointly) or under $200,000 (if filing as a single person).

For the property tax rebate portion of this payment, the rebate amount is equal to the property tax credit one qualified to claim on the 2021 IL-1040 (up to a maximum of $300). Again, to qualify, you had to be an Illinois resident and pay Illinois property taxes in 2021 on your primary residence in 2020, while your adjusted gross income on your 2021 Form IL-1040 was $500,000 or less (if filing jointly) or $250,000 or less (if filing as a single person).

My check for $255 will go to the church offering plate. Others I have talked to had no idea what I was talking about or if they had even received the check, which makes one ponder: How many got thrown away with the junk mail?

Meanwhile, on other fronts, a political advertisement for Gov. J.B. Pritzker’s re-election praises him for fictional tax relief, hinting he repealed the grocery tax and lowered the gas tax, but neither is true.

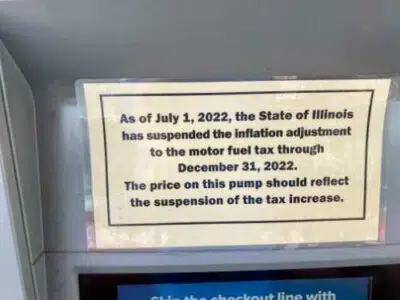

While gas prices are down slightly in Illinois during the Joe Biden inflationary economy, it is not because of reduced state gas taxes. Pritzker didn’t lower the Motor Fuel Tax (MFT); he simply delayed this year’s automatic increase until January 2023. This means Illinoisans continued to pay 39.2 cents a gallon this year until July and will then face two automatic hikes in 2023 expected to take the tax up to 45.2 cents per gallon!

Despite what Pritzker claims in a political re-election ad, Illinoisans still pay the second-highest gas taxes in the nation! After he was elected, Pritzker hiked the gas tax to 38 cents from 19 cents in 2019. He then coupled that with automatic annual gas tax hikes so lawmakers never again can be held responsible for their votes to raise gas taxes.

Another Democrat Pritzker falsehood holds he “eliminated” the 1% grocery tax. This would lead uninformed voters to believe it’s been repealed. Actually he only suspended it for one year. Illinois is the only big state in America to tax groceries. Some 37 other states believe you shouldn’t be taxed on your need to eat. If Pritzker truly wanted to help Illinoisans with tax relief every day, he’d repeal both the grocery tax and take our gas tax down to a more moderate 25 cents per gallon.

Many people this election cycle of both parties see the Hyatt Hotel billionaire J.B. Pritzker as the captain of the Titanic and many have already abandoned this sinking ship. The Illinois Policy Institute reports, “Illinois reported the largest outmigration of residents of any state during 2021, marking the 8th consecutive year of population decline in Illinois. Chicago similarly saw more residents move away than any metropolitan area in the nation.

Illinois saw the largest departure of state residents in the nation during 2021, with 68% of Illinoisans who moved saying goodbye and heading for more affordable locales, a new study found. The annual migration report from Allied Van Lines and Zillow found this trend was reflected in the state’s largest city, Chicago, which reported the most outbound moves of any metropolitan area in the nation.”

Census data offered Illinois’ population declined by 113,776 from July 1, 2020, through July 1, 2021. Nearly half of those Illinoisans moving away cited high taxes as their No. 1 reason why they were leaving. This is creating a snowball effect in that working-age families left behind mean fewer residents are left to shoulder increasing tax burdens. A United Van Lines 2020 state migration report showed the majority of Illinois residents leaving were in the highest income brackets. This study also indicated the number of residents leaving as going up each year.

A larger concern for Illinois politicians should be the employers leaving Illinois with its jobs! Fortune 500 companies such as Boeing, Caterpillar, and Citadel, are ditching their Illinois-based corporate headquarters for better economic opportunities in other states. Illinois has now lost 3 of the 35 Fortune 500 companies located there.

Illinois State Sen. Craig Wilcox (R-McHenry) summed it up very well recently, “Democrat majorities and trifecta control of Illinois have led to an alarming exodus of major corporations, small businesses and residents, and will result in long-term tax implications for every remaining Illinoisan,” Wilcox told the McHenry Times. “The continuing exodus of wealth from Illinois is a death spiral, and until voters elect leaders with a business-savvy policy base, we are doomed to read headlines like this possibly weekly, but certainly monthly for the foreseeable future.”

Census data confirms Illinois’ outmigration-driven population decline reached record levels in 2021, but this is now expected to go higher for 2022. This means more Illinois voters are voting with their feet against policies that will raise costs for the remaining residents. Illinois has the nation’s highest tax rates, second-highest property taxes, second-highest gas tax, and nation-leading pension debt; it is little wonder why Illinois also leads the nation in losing residents.

As bad as it is, if unions get their way and voters on November 8 approve a “Worker’s Rights Amendment” to change the Illinois Constitution, union demands for a wide range of areas could lead to strikes as state and local governments turn to taxpayers to try to satisfy these new demands. The concern about the passage of this amendment is it will basically give labor unions carte blanche to ask for whatever they want, as the language of the bill is so broad that nobody even knows really the full extent of what the effects of this will be in the future. If it passes, Illinois will become the fourth state to have similar protections in its constitution favoring labor unions.

It is important for Illinois voters to wake up. It has been said the 50 states of the United States of America cannot file for bankruptcy to get out of their bad spending habits leading to their debt. This means only several other options exist.

- Dramatically reduce the size of government (Illinois has the most governmental bodies at 8,923 of all other states).

- Implement a progressive income tax whereby the wealthiest of the state pay more in taxes.

Given the performance of Democrats in Illinois, one would logically expect a red tide next month in the Illinois midterm election. If that fails to come to pass in 2022, one has to wonder; Are the majority of voters of Illinois brain dead, or is the election fixed in favor of the ruling party?

If Illinois voters mistake these token measures of Democrats’ tax relief to be permanent, brain dead has to be the logical conclusion.

Copyright © 2022 by Mark S. Schwendau

~~~

Mark S. Schwendau is a retired technology professor who has always had a sideline in news-editorial writing where his byline has been, “Bringing little known news to people who simply want to know the truth.” He is a Christian conservative who God cast to be a realist. Mark is an award-winning educator who has published seven books and numerous peer-reviewed trade journal articles, some of which can be found on the Internet. His father was a fireman/paramedic, while his mother was a registered nurse. He holds multiple degrees in technology education, industrial management, OSHA Safety, and Driver’s Education. His website is www.IDrawIWrite.Tech.

Democrats are always Looking to Buy Votes. That\s the only way they can get elected.