The IRS will answer your calls faster for a few years, but into 2031, enforcement is what it’s about. They’ll hound you, audit you, and seize your money with the billions more The Inflation Reduction Act awarded them.

WXYZ News reports, “The IRS says it answered 2 million additional calls this year, helped out 100,000 taxpayers face-to-face, and cleared its backlog of 2022 filings. It’s quite the improvement over last year when the IRS had its worst year for customer service ever.”

“The IRS has made immediate use of the $80 billion that came its way as part of the 2022 Inflation Reduction Act. IRS Commissioner Daniel Werfel plans to space the funds out over the next ten years to continue to improve service, connect taxpayers with more incentives and make better use of new technology.”

Then they mention, “The IRS will also put new focus on tax noncompliance, particularly by high-income individuals and companies. The IRS says noncompliance leaves about half a trillion dollars on the table every year.”

That sounds like one of the government’s imaginary numbers. More on that below from CATO.

We aren’t picking on WXYZ; other media said much the same thing or ignored it.

According to Forbes, they can’t change the enforcement piece. Only Congress can. That is true, but the point is that the billions are going to the IRS for enforcement. Democrats pushed it through with The Inflation Reduction Act and the help of RINOS in the Senate. No one is blaming the commissioner. That’s just a distraction. The Biden IRS is greatly accelerating audits, and it won’t be of the rich. Most audits are of the middle class.

Yahoo reported the IRS is trying to make tax filing day easier. They really know how to make a silk purse out of a sow’s ear.

On the other hand, The Washington Examiner reported accurately on the picture presented by the IRS, which was less than honest.

“Even though funding for taxpayer services makes up only 4% of the supplemental budget,” The Examiner wrote, “the IRS report is laser-focused on highlighting that small component of the plan. If the IRS were a real estate agent, it would have just spent most of the home tour showing off the nice walk-in closet after rushing us through the rest of the house in the dark.

“Like a real estate agent trying to sell a house on a crumbling foundation, IRS officials are keenly aware of the public’s distaste for more audits, asset monitoring, litigation, and other parts of enforcement.”

The actual figures tell the story. You can always count on CATO and Chris Edwards to honestly rundown the funding.

The IRS expects to spend less than 4% of its $45.6 billion supplemental budget for audits and other enforcement by the end of fiscal 2024. That will leave a nearly $44 billion supplemental enforcement budget to be spent in fiscal 2025 through 2031.

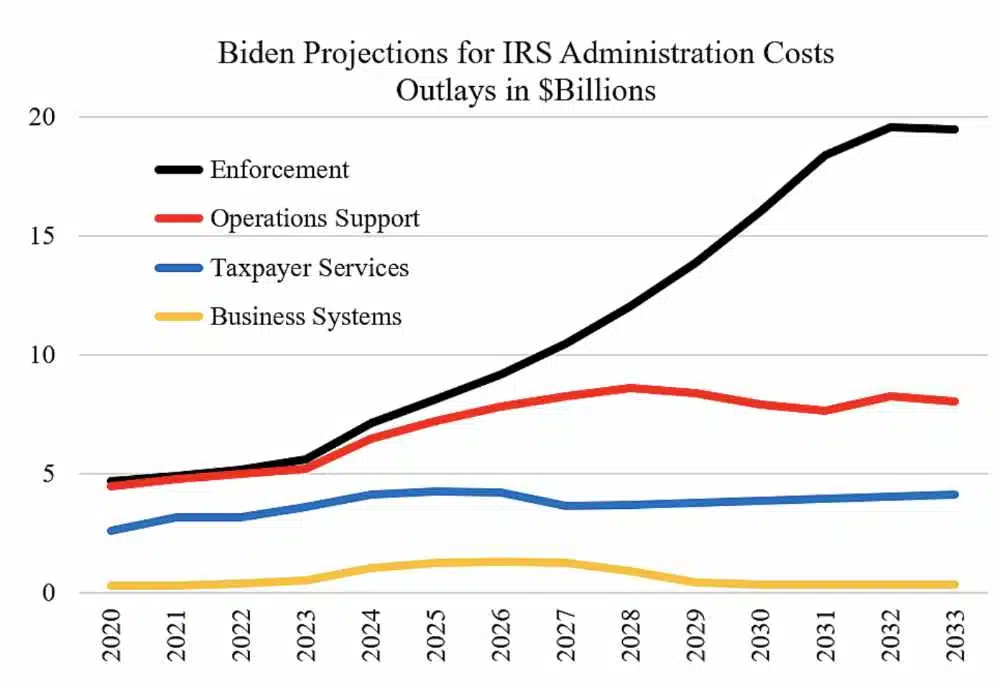

The chart shows President Biden’s budget projections for the four main parts of the Biden IRS administration. It’s the bottom line.

“The IRS has published a Strategic Operating Plan to allocate all the new cash. Of the $79 billion increase, $45.6 billion will go for tougher enforcement, $25.3 billion for operations support, $4.8 billion for business systems (computers), and $3.2 billion for taxpayer services,” Edwards reports.

“However, the huge expansion of enforcement is a mistake. The latest IRS “tax gap” estimate shows that tax cheating is not increasing, but rather has dipped as a percent of GDP. Furthermore, Americans are quite honest on their taxes with about half the rate of cheating as the Europeans. And finally, more enforcement equals less civil liberties.

“The chart shows President Biden’s budget projections for the four main parts of IRS administration. Enforcement spending is expected to almost quadruple from $5.2 billion in 2022 to $19.5 billion in 2033. The figures include the IRS base spending plus the added $79 billion.

But what about the 87,000 armed IRS agents?

Why does every Bureaucracy in the Federal Government seem to create it’s own privater Army?