The timeline of the taxman is quite short. The Inflation Reduction Act shortened it. They’re coming for all of us in several years or sooner, mush sooner, except for historical numbers.

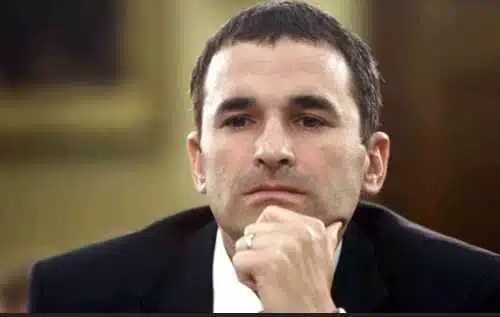

In February, if confirmed as IRS commissioner, Daniel Werfel said he would commit to not increasing tax audits on businesses and households making less than $400,000 per year.

The Inflation Reduction Act — the tax and climate package enacted last summer — earmarked $80 billion for the IRS over the next decade and a half. The money is intended in part to facilitate more audits of corporations and wealthier individuals.

Ahead of the bill’s passage, Treasury Secretary Janet Yellen pledged that there would be no increase in the audit rate for households and small businesses with annual incomes below $400,000 “relative to historical levels.”

Whatever historical levels mean!

In August, the CBO confirmed that the Inflation Act unleashes audits and enforcement on families making less than $400,000.

In September, Werfel said he would pursue equity in audits, which likely means the onus would be on white people.

According to a report by The Washington Times, IRS Commissioner Danny Werfel told Congress on Thursday that taxpayers with incomes under $400,000 won’t have to worry about an increase in their rate of audits for “several years.” For now, he said he’s pouring all of his new audit money into high-income filers.

He also acknowledged that his agency is hiring some armed investigators but said they are a tiny fraction of the overall hiring. He said most of his focus is on audits and customer service.

Mr. Werfel defended his request for $1.8 billion in extra money next year, on top of an $80 billion plus-up the IRS received in last year’s budget-climate bill. That $80 billion will be stretched out over the next decade.

We’re Not Done Yet!

However, NTD reports IRS Commissioner Danny Werfel, under a grilling by the lawmakers on Capitol Hill, hinted that there’s a chance that the agency will—contrary to its repeated pledges—increase tax audits of Americans earning under $400,000.

Mr. Werfel said he had instructed staff at the IRS not to raise audit rates for lower-earning Americans but hinted that there’s some chance this could (inadvertently) happen, and only time will tell.

After Mr. Palmer questioned Mr. Werfel, Rep. Virginia Foxx (R-N.C.) pressed the IRS chief to explicitly guarantee that the IRS wouldn’t raise audits on Americans making less than $400,000.

“That is my marching order to the IRS,” Mr. Werfel replied before adding that “if we fall short of that, I will be held accountable for it,” hinting that, even with the best of intentions, there’s a chance that the IRS might fail to make good on this promise, much like the watchdog has warned.

I think you only have to worry if you are a conservative!!!

Just want to say thank you for including a Truth Social button in your sharing choices!

Anyone see the irony here? They’re hiring 80,000 IRS agents and we’ll have to pay their salaries, healthcare and benefits. This government doesn’t care how they spend other people’s money.

Helathcare t9r their families, too, plus lifetime pensiòns and some disability claims for papercuts.

We are not spending tax dollars. All of our tax dollars were spent by the end of spring. Now, we’re just spending freshly printed dollars. And we will need to print even faster. Because, each one they print, lowers the value of all of the rest, and will continue to do so until it is worth, nothing. We have become… Read more »

AND spending money BORROWED from CHINA!

Need to change the Income Tax law! Flat tax for everyone!!

In principle, I’m with you. However, I believe the Fair Tax proposal is much more advantageous to the tax payer. Look into it. I think you will agree.

Income tax is illegal!! The 16th amendment that allows the corrupt government to steal your income, was never properly ratified.

ReFucklicans in congress and house LOVE spending money too….its NOT just a biden/demorat side gig

It is a Democrat and Rino side gig only!

Somewhat true. However, the Republicans can go down as voting against this bill 100%. In the meantime, they also ran on defunding it if they got control of the house in 2022….crickets.

Unfortunately, you are correct–HOWEVER, the ‘republicans’ who join in with the nonsense are NOT Republicans (that is, True Conservatives) at heart. That’s why they are called RINOs.

Slaves, keep filing your 5th Amendment violating self confession tax returns to It’s Really Slavery. Commie democrat scum need bribe money to buy votes from lazy freeloader filth.

There is no constitutional right to refuse to file an income tax return on the ground that it violates the Fifth Amendment privilege against self-incrimination

There is no Constitutional allowance for an IRS or anything like it. It is unconstitutional for them to require us to fill it out to begin with.