PPI AT A SCORCHING 6.2%

Producer inflation is running hot.

St. Onge explains in the video below.

“Yesterday, the BLS came out with the April Producer Price Index data. This measures the prices received by domestic producers for their output. So it’s basically inflation for business.

Core inflation is a different matter.

“Inflation numbers beat every Wall Street prediction, reporting a 6.2% annualized pace of price hikes. Core PPI, which includes food and energy, actually more than doubled the Wall Street estimate at the same 6.2%.

“That brings the past four months of PPI to an average of 4.1%, compared to the previous four months in the middle of last year when it was declining by half a percent per month.

In fact, this was the fastest annual PPI increase since April 2023, when Biden inflation was supposedly on its last legs in terms of what was driving it.”

Of course, it’s the money printing. So print $6 trillion, and poof, prices go up, St. Onge continued.

Government spending was the big increase, which “leapt 20% annualized in the month. The government is buying up enough resources to drive up prices for everybody.”

“This marks the sixth month of accelerating inflation. Meanwhile, the economy is slowing, with GDP growth dropping by a third to barely above population growth.” Depending on how many random millions we have just imported, it could actually be below population growth.

Accelerating inflation and falling production have led to widespread predictions of stagflation, which Jerome Powell addressed two weeks ago, saying he doesn’t see stagflation and deflation. However, in DC, you only see what you are paid to see.

Producer inflation comes in at a scorching 6.2% annualized. Thrilling the easy-money Welfare Queens on Wall Street.

That makes 6 months now of accelerating inflation, both at the consumer and the producer level.

The biggest jumps were energy and government spending, but… pic.twitter.com/XcYqwTj5jr

— Peter St Onge, Ph.D. (@profstonge) May 15, 2024

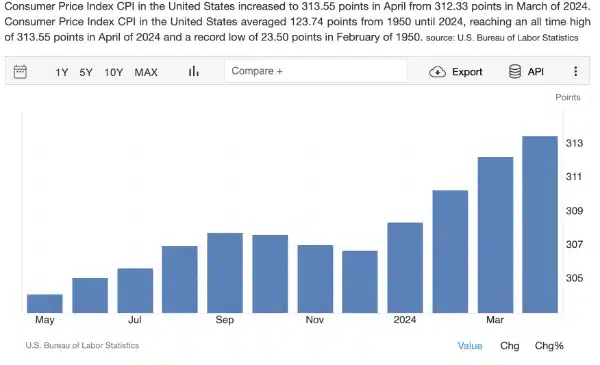

THE CPI

According to Business Inflation (CPI), it was up another 3.4% in April, and prices are still elevated. The Labor Department said that the consumer price index, which measures the price of everyday goods, including gasoline, groceries, and rent, rose .3% in April from the previous month. Prices have climbed to 3.4% from the same time last year. This is just the inflation for business.

Joe Biden continues to claim inflation was 9% when he took office in January 2021. A report from the US Department of Labor, Bureau of Labor Statistics found that the consumer price index inflation rate was 1.4% in January 2021 when Biden came into office.

Consumer Prices Have Risen Every Month Since ‘Bidenomics’ Began, Up 19.5% To Record High https://t.co/hdvSVC0gjo

— zerohedge (@zerohedge) May 15, 2024

A trillion in debt every three months and inflation isn’t in double digits? Just wait a bit.

I fear we ain’t seen nothin’ yet …

They are right on track to ‘royally screw us all’…