Economic Deceits are Debilitating the Republic

by Bob MacGuffie and Antony Stark

Americans not succumbing to the spell of the incessant leftist propaganda machine are acutely aware of the financial peril into which the ruling political and financial classes have driven us. Most may be unaware of the technicalities of the crisis, but they innately recognize that the government cannot live beyond its means, running budget-busting deficits for decades, without precipitating a consequential national financial reckoning which will shift the ground beneath the feet of every American.

The financial crisis of 2008 marks the point at which our nation slipped into a permanent state of the economic crisis which has only intensified and continues today.

Leading to the crisis, during the unraveling years of the 1990s the unrelenting increase in federal debt constituted a steady, dour, and uneasy background drumbeat to a seemingly robust and expanding U.S. economy. In 1980 U.S. debt was just under one trillion dollars. By 1990, it had grown to $3 trillion. When George W. Bush took office in 2001 it was $5.7 trillion, almost doubling during the decade. It was clear the country was habitually living beyond its means.

The debt almost doubled again to $10.6 trillion during Bush’s tenure, then almost doubling again to $19.6 trillion during the Obama years. It is both astounding and alarming that from the first administration of George Washington to Ronald Reagan the country accumulated less than one trillion dollars in debt, but then in just 40 years accumulated another $19 trillion. The media never covered this with the seriousness it warranted and anyone watching with open eyes knew we had crossed a financial Rubicon. We could refer to this building debt bubble as economic deceit number one; it is the Millennials and Gen-Zs who will be saddled with its debilitating effects.

The seminal event ushering in the permanent crisis was the national and worldwide financial crisis that erupted during the presidential campaign in the fall of 2008. While the banks reduced interest rates and reduced mortgage qualifying criteria and down payment requirements, a massive housing debt bubble developed in the early part of the decade. The government compounded the financial risk through its Fannie Mae and Freddie Mac guaranteed mortgage programs, which simply encouraged riskier behavior on the part of both lenders and borrowers.

When the mortgage bubble burst, the impact so crippled the financial system that Federal Reserve and Treasury leadership determined that the banking system should be bailed out in total via the Troubled Asset Relief Program (TARP) rather than let the bad actors face the consequences of their poor decision making. Congress rubber-stamped the plan. Regardless of whether they wanted, or needed federal assistance, CEOs of eight of the largest U.S. banks were summoned by Treasury Secretary Paulson to the White House and compelled to sign a one-page letter of participation in TARP. By stepping in, the government established the corrosive concept of “too big to fail”, thereby creating a perpetual moral hazard in the financial system. That is, it gave a clear signal that there would be no consequences for poorly considered investments, no matter how catastrophic, because they would be back-stopped and made good by the taxpayers; in such a case, what is left to stop businesses from taking even worse risks in the future?

Virtually all bank management in the country remained in place, and though charges of illegal practices were aired throughout investigative reports in the media, not a banker was prosecuted for any fraudulent activity during or after the entire crisis. Between ‘too big to fail’ and the lack of will to prosecute, the moral hazard in the U.S. financial system was amped up to a realm where there are no consequences and there is no turning back. This hazard has been a poison permeating the entire financial system going forward.

Next, the Federal Reserve immediately commenced its controversial program of Quantitative Easing (QE). Its ostensible purpose was to provide massive liquidity to the banks so lending could begin again, thereby stimulating the economy out of the recession and set GDP onto a sustainable growth path. All sounds great until you understand its mechanics. The Fed bought the impaired mortgages and other securities from the banks, providing them the cash to restore their balance sheets and commence lending. In addition, the Fed also began purchasing U.S. Treasury securities directly from periodic Treasury auctions. To make an inconvenient truth of it, one arm of the government was issuing debt and another arm was purchasing it. We are a republic, but we are not supposed to be of the banana variety. The stated objective was to keep interest rates low while stimulating demand and growth.

But where did the Fed get the money or credit to purchase these assets? They simply created it out of thin air within the bowels of its secretive un-audited operations. They make the necessary entries and overnight the banks have new reserves, entered as payables, in their respective accounts with the Fed. This is what’s commonly referred to as “printing money” and the Fed added to the money supply by printing some $2 trillion in four rounds of QE from 2008 to 2014, quadrupling its balance sheet to $4.5 trillion. This perfunctory absorption of bad debt and bad decisions from the shoulders of the bankers to the belly of the Federal Reserve could be referred to as deceit number two.

In the years following the conclusion of the QE program, it is alleged but many astute observers, that the Fed, with the cooperation of other member banks and other central banks, has continued to surreptitiously buy bonds on the open market – all in a desperate effort to keep interest rates low enough so the interest carrying costs can continue to be “afforded” in the federal budget. Although it is practically impossible to prove, those watching trading on a daily basis see massive bond-buying within the hour whenever stock prices begin to rapidly decline. With rates in a historic trough, there is just no reason individual bond buyers would be rushing in, on the hour, to support the prices of bonds. Low interest rates in the bond market are the principal factor keeping the stock market afloat, and indeed the world economy since the ’08 crisis. Deceit number two begets deceit number three.

The national debt and its financing mechanism are a tectonic plate supporting the U.S. economy including financial markets, inflation potential, dollar valuation, commercial and consumer credit, and employment. Financial plates have shifted significantly along this fault line during the Pandemic, with the entire economy shaken to its core, revealing the crisis of ‘08 as merely the early warning tremor of an ultimate financial reckoning. Little discussed in the media in the decade following the ’08 crisis, and never with the appropriate weight, the national debt is a ticking bomb with the potential to ignite an international financial and social calamity climaxing with the potential to engulf the world’s major economies. Gen-Zs and Millennials will need to strengthen themselves with the will to see the Crisis through with an agenda of Ordered Liberty and limited government principles. A keystone in executing a successful strategy will be the devolution of power from the federal government to the states. Should the young generations fail to rise and overcome the course of the Crisis that is upon them, they will find themselves in the position of impoverished serfs in service to and dependent on the highly questionable “social conscience” of an all-powerful Administrative State.

The fourth, and certainly the most tragic deceit for the average American is the half-century and continuing decline in our standard of living. Asserting that Americans’ standard of living is in decline may be surprising to many readers accustomed to the illusions of prosperity promulgated by our ruling financial elite. But when evaluated outside government-issued statistics, daily merchandising distractions, and illusions in the social media world, the reality is Americans’ fundamental standard of living has fallen markedly from that of the 1950s and ‘60s.

The quickest thumbnail measure of course is the inflation rate over the intervening decades. However, federal government methodology for developing cost of living, inflation, and the resultant standard of living comparisons has become so distorted over the years as to be rendered close to meaningless. The methodologies at the Bureau of Labor Statistics, Congressional Budget Office, and Census Bureau develop a myriad of reports which inexplicably include and exclude items at whim, seemingly to produce measurements predetermined by Administration and Congressional leaders. Apparently, key household needs such as fuel, medical care, education, automobiles, and housing itself are subject to modification, weighting, averaging, and exclusion from inflation and cost of living calculations. A reading of the empirical justification for these calculations quickly becomes laughable.

Government statistical development is the black box from which we are propagandized that inflation remains well under two percent and in some years virtually nonexistent. All while different elected federal mouthpieces incessantly remind us of the prohibitive costs of higher education, healthcare, and housing. Raving Democrats have declared “crises” in each of these sectors. Do they realize how ridiculous they sound? Evidently, they think we have the memory span of tropical fish.

Reality is that inflation for items necessary for modern life, i.e., housing, education, healthcare, automobiles, has been raging for decades, causing a precipitous decline in our standard of living. However, the American public remains distracted by incredibly cheap consumer electronics and clothing from China and the Far East. These distractions provide fertile ground for propaganda to take hold. There is certainly more “disposable income” available today for electronic gadgets, dinner out, and modest vacations, but the availability of these ephemeral experiences is a diversion that masks a fundamental decline. And it all seems manageable when it is financed through long-term payback credit cards and other consumer debt schemes.

Due to the incredible capitalist economic machine and the ingenuity and productivity of the American worker, the U.S. standard of living continually rose from the nation’s birthright on into the 1950s and ‘60s where it topped out. The history of this deceit warrants an entire book, but we offer a couple of key benchmarks to consider.

Median household income in 1969 was $9,400, while four years’ tuition at a private college was averaging $6,000. Median household income in 2018 was $63,200, while four years’ tuition at a private college averaged $164,000. So four years of college in 1969 was just two-thirds of annual household income compared with four-year tuition of some 2.6 times annual household income in 2018. This represents a real fourfold increase in the bite of the household economic pie for just this one item, for just one child.

The average price of a 1969 car was $3,000, representing 33 percent of annual household income. The average 2018 car was $37,500, some 60 percent of annual household income, a virtual doubling of the demand on household income. But of course, not many can afford to outright own a new car anymore – most people are now reduced to leasing them.

The average price of a private home in 1969 was $25,000, representing 2.7 times annual household income. The average home price in 2018 was $237,000, some 3.75 times annual household income – a 40 percent larger bite of the family’s income. But Americans are told that it’s “affordable” thanks to the palliative of inordinately suppressed interest rates.

And then there’s healthcare. In 1969 some 80 percent of Americans with health insurance received it through an employer-sponsored plan which the main breadwinner of the household received as a benefit from his employer – and most employees didn’t even have to contribute to its cost! But today, after ObamaCare, health insurance has become the biggest political football of the last decade as costs have increased massively, and individuals have had to bear an increasing share of the costs. Largely, as a result of government interference in the market, health insurance now takes a larger bite of the household budget than any item other than the mortgage…and for many – more than the mortgage. And in 1969 this vital service was hardly an item in the household budget!

In the 1950s and ‘60s, in a majority of households, there was only one breadwinner – the stay-at-home mom was the rule, not the exception. Everything necessary was provided for on one salary, generated from likely a quite unremarkable occupation. A man could get a job repairing cars, selling shoes, construction work, driving a truck and in a few years, he could afford a home, a car, and have a wife at home raising a couple of kids. They didn’t have money to go out to dinner every week, but all the important items necessary for middle-class life were indeed affordable. And with credit cards in their infancy, consumer credit was limited to cars and an occasional household appliance.

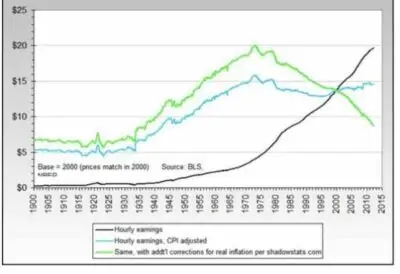

Today, that same family has both parents working, at least one in a professional position and the entire household is likely floating on a river of consumer debt. The following chart illustrates a decline in the American standard of living of some 57 percent since the late 1960s.

The Bureau of Labor Statistics provides the black static hourly earnings line, with two overlays. The blue line accounts for the Consumer Price Index and the green factors in inflation. Sadly, the green line illustrates the unvarnished reality. Look at any historical standard of living, real inflation, or dollar purchasing power chart, and you will see the same sharp inflection point in the early ‘70s as you can see above. There is a very definitive reason all such charts will inflect down, or up depending what is being measured, illustrating the change to a negative trend in the early ‘70s. On August 15th, 1971 President Nixon severed the last link between the U.S. dollar and the gold reserves of the United States. Without being tied to physical gold, the historic preserver of value over the centuries, the dollar’s accelerating loss of purchasing power can be traced to this historic decoupling event.

The explanation for the decoupling given at the time was that foreign banks and governments were presenting dollars for conversion into physical gold at an increasing pace that was depleting the nation’s gold reserves to unacceptable levels. Nixon’s solution was to shut the gold exchange window and let the dollar’s value float against the other currencies. The immediate result was an economic lost decade of high inflation and unemployment, stagnant wages, and minimal opportunities for college graduates. Most all middle-income households became two-wage-earner families by necessity during the decade. Americans became used to running to keep up, and borrowing to make up the difference.

The Reagan Administration’s free-market and tax-cutting policies got the economic wheels turning again, but America’s standard of living was still traveling on the downward slope of a great historic arc. The great high following the crisis of WW II and all the attendant economic benefits of that U.S. victory had run its course. Government had become far too big, intrusive, and expensive. But the body politic, rapidly being populated by Baby Boomers, had no appetite to do what was necessary to cut it down to size and restore the arc to its upward slope. In fact, the Boomer-dominated electorate chose unbridled entitlement, growth, and accelerating deficit spending.

Instead of seriously attending to those challenges, the “culture wars” moved to center stage, and in the era of sluggish productivity, Americans looked away and sealed their fate, continuing along with the standard of living’s downward slope. Should the Millennials and Gen-Zs turn away from the reality of their declining standard of living, the majority of the professional class of their generation will never be able to own their own homes or cars. They will become a permanent tenant class.

As the 1980s turned to the ‘90s, a new financial and social elite emerged, who would foist a fifth and most insidious deceit on America. Progressive Boomers, rid of Reagan and flush with new wealth, began to re-animate the utopian dreams that made their blood run fast in the 1960s. In addition to their growing hegemony of academia, they were now stepping up into senior leadership in the business and political world. How could they expand and accelerate the development of real wealth for the broader segment of their elite? Enter the big con of comprehensive international trade deals. And who better to sell it than the Boomers’ first serious candidate for the presidency, Bill Clinton.

Computers became ubiquitous in the ‘80s, most visibly as they penetrated the consumer marketplace. But they were also impacting business, revolutionizing industrial processes, and shifting competitive advantage right beneath the feet of the new corporate titans. Before 1990 the only international threat faced by the American worker was the importation of competitive products. Though crafty importers could displace some U.S. workers on occasion with a hot new imported line, no import ever shook the underpinnings of the American worker. But computers were now enabling the remote assembling of component parts, and corporations were setting up assembly lines in undeveloped countries. The wage disparity was proving to be an enormous boost to corporations’ bottom lines, and they wanted more of it.

What began with a trickle of “off-shoring” components quickly grew into complete operations, and ultimately entire factories. It seemed a disruption at first and was overshadowed by consumers’ satisfaction with the importation of inexpensive, quality electronic gear of all types. Overnight, India seemed to become the go-to haven for software coding and data processing. Then suddenly it seemed every repetitive process job was pulled out from underneath the American workforce. By the time the automakers were moving major operations to Mexico or East Asia, American workers knew they were in trouble.

While the international competition was driving the exodus of so much manufacturing, the corporate game plan seemed to be to restructure to keep the high value-add knowledge work in the United States. Youth was flooding into American colleges, and the economic theory was that the American workforce could move up the value chain of knowledge-work, thereby increasing its earning potential as it left the lower value-add assembly work for low-wage developing countries. But for a multitude of reasons, too many American workers were not training up for the new knowledge economy which seemed to be shrinking opportunity in their eyes, not growing it.

Capitalizing on a brief S&L failure-driven recession, globalist Bill Clinton marched in, seemingly with an economic plan for everyone. Promising a grand North American Free Trade Agreement, the slick-talking one had an answer for everything. Why those left behind displaced workers in Pennsylvania, Ohio, and Michigan would get spanking new federal worker re-training programs for every manner of new-fangled knowledge job! Vote for Bill Clinton and he would “focus like a laser” on revitalizing America in the new globalist economy. It didn’t happen.

Instead, NAFTA was signed in Clinton’s first year, 1993, and the prophesy of his independent rival for the presidency, Ross Perot was being realized. Yes, we all heard about that “giant sucking sound” Mr. Perot warned of during the campaign. Perot was ridiculed for saying that NAFTA would drive hordes of complete factories out of the country so fast we’d hear a sucking sound in the wake of their evacuation. The man was a bit of a flake, but he hit the bullseye dead on regarding the catastrophic impact Clinton’s trade deals would have on America. Clinton opened the floodgate for a startling exodus of great American manufacturing plants that had formed the life-blood for countless families throughout the country….for generations.

As the domestic impact came into focus at the turn of the century, honest economic analysts were becoming troubled as the data began to take shape. Large corporations that offshored much of their production still seemed to create plenty of new design, engineering, marketing, and finance jobs in the United States. But for the medium-size and small companies that focused on the domestic market, offshoring was simply exporting jobs to a foreign country. Many a small firm head who personally knew his workforce, was troubled by the practice but did it simply to remain competitive and survive. A decade later the corporations were finding that product complexity was requiring they move more and more design and engineering jobs overseas to integrate with manufacturing.

The original theory of the case was that offshoring would be a win-win for the United States and its offshoring partners. The United States would be importing cheaper products, providing an economic benefit to domestic consumers, while the Chinese would have a new-found income to spend on products from the United States. But not surprisingly to observers with a decent memory, the Chinese markets were proving as hard to penetrate as the Japanese twenty to thirty years before. The Chinese went to school on the Japanese fine art of making their markets impenetrable. This generated perennial trade deficits with China. Plus, it was no secret that China structured all joint ventures so it could regularly steal as many trade secrets and intellectual property from U.S. designers as possible.

The Chinese also mimicked the former Japanese practice of reverse-engineering and copying U.S.-designed products with the technology stolen via joint ventures with U.S. companies. They then marketed their own product lines, serving the domestic markets the joint ventures were supposed to serve, thereby crowding out U.S. opportunities, revenue, and profit streams. The results of all this economic subterfuge are the $500 billion annual trade deficits often cited by President Trump. Economists differ on the magnitude of outsourcing’s impact on the U.S. employment picture. But undoubtedly it has been a significant contributing factor to both U.S. structural unemployment, and the continuing decline in real wages.

Even in light of the ongoing significant trade deficits, an honest economic analysis must account for the tangible benefits to the U.S. economy. Profits generated by the firms flow to shareholders and investors, which are further invested or spent in the United States, thereby having a positive impact on employment. In addition, both the consumer and commercial customers of these companies have benefited from the lower prices.

But in a broad sense, far too many average workers in outsourced industries have been left high and dry, or should we say “beached” over the past thirty years. These inequities must be addressed in any U.S.-led prospective trade agreements with China. But these strict economic considerations are now being eclipsed by the national security issues illuminated by China’s handling of the Pandemic. As the Wuhan Virus spread across the globe in the spring of 2020, the scales were lifted from the eyes of some leaders in the West. After all, the Chinese strategy for global dominance was written in plain sightsee programs such as “the Belt and Road initiative,” “Made in China 2025,” and “China 2049.” The goals of the Chinese leadership, the CCP, is to dominate the globe both economically and militarily. The economic goals for the United States need to be brought into alignment with its imperative national security interests, i.e., on-shore back to the United States every national security-related economic operation currently on Chinese soil – ASAP! That includes a wide breadth of U.S. industries, particularly pharmaceuticals, military manufacturing, high-tech, engineering, and any feeder industries to them.

Many corporations profiting mightily from offshoring in these industries will need to be patriots first and seekers of profit second – we’ll see on that one. The loop has really closed on the off-shoring strategy. The economics of it all needn’t be debated any longer: national security-related industries need to be on-shored; other off-shored operations would be wise to recognize it is in their best interests to shift their off-shoring to non-totalitarian developing countries. Millennials and Gen-Zs currently rising in corporate America need to face this patriotic reality and act upon it within their organizations.

The past two decades have seen a massive and, to many, an alarming increase in government deficit spending and the resultant towering rise in Federal debt. As this century opened, the national debt stood at $5.6 trillion. As of the closing days of 2020, it exceeded $27 trillion, and driven by Pandemic-related stimulus, is increasing by over $8 billion a day in 2021. This is truly unprecedented in the history of our country, for the national debt first breached just $1 trillion as recently as 1982. Today, it is widely acknowledged across both the political and economic spectrums that this debt is not going to be paid down. An honest accounting of the nation’s books would indicate that because of this currency debasement there’s a reckoning coming regarding the value of a dollar and its purchasing power. Some in public life realize this, many do not, and none will speak of it publicly.

Though the debt expansion has increased under both Democrat and Republican administrations, the main drivers of the debt are the out-of-control Federal “entitlement” programs of Social Security, Medicare, and Medicaid. They represent more than 50 percent of the annual federal budget. Under pressure from the Tea Party Movement, some Republicans had called for reform of these programs, but the RINO Republican addiction to the bi-partisan “spend and elect” philosophy of Big Government, caused them to melt before the scoffing and demagoguery of the Democrats at the very mention of entitlement reform. But the bottomless Leftist think tanks and “Intelligentsia” have spawned a creature designed to permanently de-fang the issue of perpetual annual deficits and soaring national debt by rendering it moot – Modern Monetary Theory (MMT).

With a straight face, we are conveniently told by academics and deep state “economists” that the deficits and debt don’t matter any longer. MMT posits that government spending doesn’t need to be “paid for” because governments, which issue fiat currency, can always pay back maturing debt by issuing more fiat currency. To ward off the problem of financing the debt, MMT advises keeping interest rates on federal bonds at near zero. Now isn’t that an explanation that is tailor-made for carte-blanche spending for as far as the eye can see? The only problem MMT foresees is the potential for inflation, but it posits that problematic inflation can only occur when the economy pushes beyond full employment. At that point, MMT proposes reducing spending and raising taxes. In the MMT fantasy world, all wealth derives from the government; that is, the more the government spends our own money, the richer we will all become.

As such, Modern Monetary Theory (MMT) is the most current snake-oil economic theory that is increasingly being sprinkled into the Left’s most audacious spending proposals in order to make them seem plausible. Those who push MMT believe that any government that issues fiat currency can do so without any fear of becoming insolvent because in their view currency has no objective value; therefore, the state can always print more money as it requires. From this, it follows that budget deficits don’t matter because, after all, the state can just create more fiat currency to pay for it. Further, since the printing of money out of thin air replaces the need to tax workers to get money to pay for government spending, the very role of taxation becomes the simple regulation of aggregate demand. In essence, MMT claims that money has worth because the state says it does. Hence, it is claimed that a country’s National Debt is payable simply by creating fiat currency and thus obviating the threat of default. Therefore, if government spending has been set free from the constraints of having to raise tax revenue because it simply creates “money” as it is required, there is never any risk of insolvency. It is upon this utter absurdity that MMT is based and it is why it is so dangerous.

The Economy is a multilayered phenomenon; on the top layer is the consumer economy as it is lived through everyday transactions: work, wages, consumer spending, saving, and investing in the future. The consumer economy functions symbiotically with a commercial economy consisting of manufacturing, services, business start-ups and expansion, business borrowing, investing, shareholder ownership, and valuation as expressed on the various stock exchanges and equity markets. Yet at a far deeper and more fundamental level, there are elements that form what might be called “Economic Tectonic Plates”, upon which all else above them rests and whose surface stability is at the mercy of their movements. Those Economic Tectonic Plates are the Credit Markets and the critical short-term liquidity they represent, longer-term Debt (both public and private), and the Stability of the Dollar. With government spending totally out of control due to political impotence in the face of greed, interest rates will inevitably erupt and spike beyond control due to the debt’s stratospheric rise by tens of trillions of dollars, choking off the credit markets, and seizing up both banking and business operations.

The economy experienced such warning tremors in August ’07 and October ’08 and is again tracing a similar course, aggravating those tectonic plates with deficits, debt, and money printing. And like all seismic movements, it is largely not thought about as it is too horrible to contemplate. However, as those living on seismic fault lines know, when a shift happens, all that is above it is in peril because there is little shelter from the inevitable resultant earthquake.… and this is precisely the goal of the Left.

This economic crisis has been accelerating for the past decade and is sure to become intractable in this decade. A half-century of economic deceits perpetrated upon us by our ruling political and financial elite is now propelling us through a harrowing passage, leading us into a period of debilitating “stagflation” (both high inflation and unemployment) that is sure to dwarf that of the 1970s.Should events spiral completely out of control, the credit and equity markets could completely seize and implode, ushering in a true depression. By creating such an economic catastrophe of unparalleled proportions, the Left will have the Economic Crisis it seeks to exploit in order to vastly expand its power to control the chaos it has created.

It will require very tough, very hard, economic decisions to be made that are not based on ludicrous socialist fairy tales like Modern Monetary Theory in order to save the Millennials and Gen–Zs from being the first two generations in a century not to see an improvement in their lives over the lives of their parents. Given the rapid descent into Crisis that we are seeing, they will likely experience lives that are exponentially worse in terms of economic prosperity, economic stability, and, of course, economic independence and Liberty. In fact, they may be living in a world where they find themselves educated, skilled, technically proficient, eager to work… and often out of a job while living as dependents of the State!

As corporations outsource and move from full-time employment to temporary, no-benefits “gig work” more and more Millennials and Gen–Zs will find those things that have been mainstays of American life since WW II…a steady job, their own home, an advancing career, an increased salary, and ability to raise children… have become impossible pipe dreams.

Instead, they will be shifted into the uncaring, incompetent, and arrogant environs of the Welfare State, where they will become pathetic dependents who beg for crumbs from a Leviathan government that they know they cannot oppose or criticize without economic sanction and/or outright canceling making their lives infinitely worse… if not unlivable.

They will become the cursed and despised “Deplorable Class” as the elites have already identified them.

Such an economic catastrophe will be most cruel to and take its biggest toll upon, the Millennial and Gen-Z generations. The hour is getting late, and word of this impending economic catastrophe must be spread throughout these generations before they are swallowed up in the Leviathan’s maw.

~~~

Messrs. MacGuffie and Stark are authors of the new book “The Seventh Crisis – Why Millennials Must Re-Establish Ordered Liberty,” www.seventhcrisis.com which seeks to offer the Millennial and Gen-Z generations a way out of the dangerous crisis it currently faces.

You can comment on the article after the ads (please be polite to commenters), and subscribe to the Daily Newsletter here if you would like a quick view of the articles of the day and any late news:

Regarding the bending reality to the will of the faculty lounge MMT:

“There are some ideas so absurd that only an intellectual could believe them.”

― George Orwell

Aye!!!

@ Earlene,

I got ya a dollar if you can retrieve it from this fishing line.

start earning money today from hundred dollars per hour by just simple on-line working by giving only one hour of your daily life . It’s very easy. Everybody can now get this job and start earning cash online right now by just follow instructions click on this link and visit tabs( Home, Media, Tech) for more details thanks…..ExtraRich1.com

Businesses aren’t rated too big to fail and they don’t have a private banking cartel with a printing press so prices are going up up and away. The Pik N’ Pak on the block is resetting everything right now and I’m sure there will be some noticeable price increases. Maybe the comrades can tweet their lovable Uncle Joe for some… Read more »