Speaker of the House Nancy Pelosi boosts subsidies for chip manufacturers, while her husband Paul buys lots of stock in the largest chip manufacturing company.

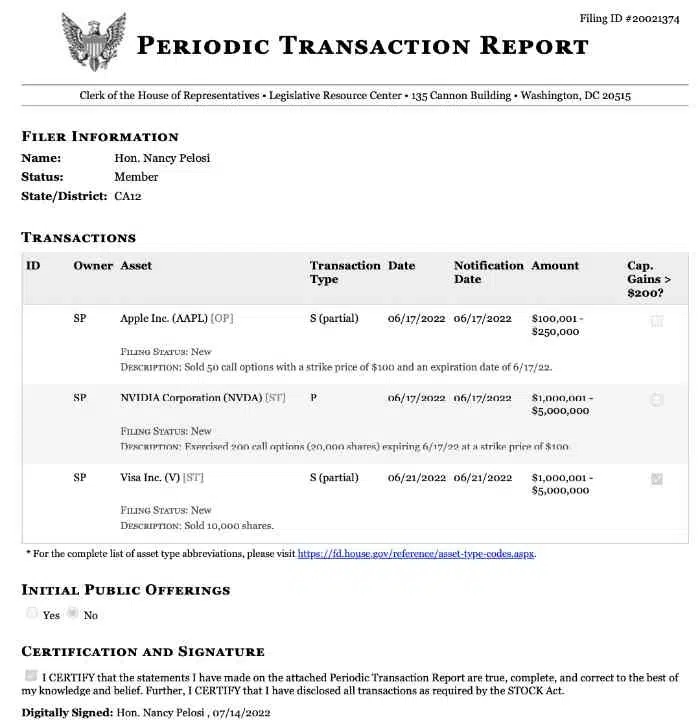

Paul Pelosi bought up to $5 million in stock of a top computer chip company ahead of a bill next week that would give billions in tax dollar subsidies to boost chip manufacturing.

Just as Nancy Pelosi is pushing to invest $52 million in computer chip manufacturers, Paul Pelosi bought the stock. Paul purchased 20,000 shares of Nvidia, one of the world’s largest semiconductor companies, on June 17th.

Looks like insider trading. The Pelosis are bulletproof.

Reuters reports that senators will convene next week to vote on a bipartisan competition bill that allocates $52 billion to boost domestic semiconductor manufacturing and tax credits for production.

It sure looks like insider trading. Did you know that there is even a stock trading app that monitors Paul’s trading activity? That way, people reading the app can benefit from insider trading also.

The two and others in Congress have engaged in insider stock trading schemes for years.

For example, weeks before the Pentagon announced a big contract with Microsoft in April 2021, Nancy Pelosi and her husband purchased $10 million in Microsoft stock in March.

WATCH:

IT’S NOT JUST THE CHIP MAKERS WHO BENEFIT

In November 2011, “60 Minutes” aired a report highlighting instances in which congressional officials reportedly bought stocks around the same time Congress discussed legislation affecting those companies or industries.

The show looked at the investments of various lawmakers, including U.S. House Minority Leader Nancy Pelosi (D-San Francisco).

At the time, it was legal for Congress to engage in insider trading. The Stock Act was passed. The Act made it illegal for elected congressional officials, their staff, and executive branch employees to use information about pending bills that are unavailable to the general public to make investment decisions. The bill would also forbid them from making such information public for personal gain. The Stock Act was gutted in 2021.

Maybe the New Congress will have some balls and go after the Crooks in Government. If not, all I see on the horizon is Civil War.