A video from Joe Blogs – who is in the UK – says the EU price cap will destroy Russia’s economy, mostly through the shortage of tankers to deliver fuel to alternate regions other than the EU.

[Since I posted this, Joe Blogs made his video private. I have no idea why, but what I wrote here were mostly his thoughts, not mine.]

The EU price cap on Russian oil will be enforced by an insurance mechanism. They won’t be able to insure any fuel that exceeds the price cap.

TANKERS IN SHORT SUPPLY

Russia will become dependent on Turkey, China, and India to pick up the slack on the reductions in oil in the EU, but they won’t have enough tankers.

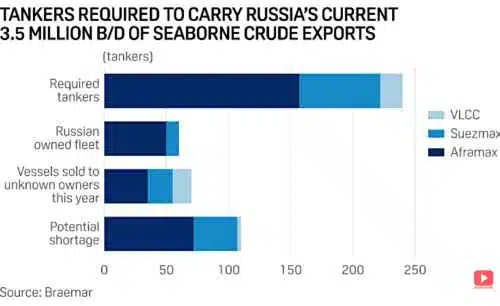

For Russia to be able to transport the 3.5 million barrels of oil it currently sells across the seas each year, it will need 150 Aframaxes, 65 Suezmaxes, and 18 Very Large Crude Carriers.

The Russian currently-owned fleet has 50 Aframaxes and 10 Suezmaxes. It doesn’t have any very large crude carriers.

All the tankers sold on the market are not registered yet. We don’t know who owns them. But, even if all the tankers are owned by Russia, the sales only include 10 Aframaxes, 10 Suezmaxes, and 15 very large crude carriers.

Even if Russia has access to all the newly-acquired ships, Russia still faces a shortfall of 110 tankers to be able to transport all of its oil. That does not allow it to replace its lost EU sales.

A lot of the ports Russia uses in the winter are very cold; they need tankers that can move through the ice.

They will likely be unable to move the amount of oil they have in the past. It also appears they won’t be able to avoid the oil price cap the EU is looking to impose. Russia plans to build its own ships, but they need capital to do it.

If Russia tries to increase its prices, its oil will be less desirable. All indications are that their sales are dependent on cheap oil.

Russia needs 110 tankers to deliver more fuel. As they lose money and have to sell at discounted prices, prices are going down worldwide. They won’t have the money to invest in infrastructure, namely tankers.

The price cap will be about $63 a barrel, which allows Russia only to make a small profit.

It will be very difficult for Russia to pivot in time.

A commenter on his youtube channel added the insurance problem to the mix:

Very good points that you bring up, Joe. Another thing to consider would be the insurance that most ports around the world require to even enter the port. The insurance, as I understand it, would be required to pay for any clean-up or anything else which happens if the ship were to cause damage.

Now, with most of the companies that offer insurance residing in the west, Russia can’t get insurance unless it agrees to the price cap. I think that Russia could “self-insure,” but with the drain on Russia’s coffers due to the war, what country would want to take the risk of expecting Russia to pay for the damage in a timely manner, especially if they only pay in rubles?

Second, if they have to put money into a holding account in case there is damage caused by their ships, it further hurts their economy as those tied-up funds can’t be used for their infrastructure, buying weapons, and will hurt their overall profit.

As Dr. Sal said in an earlier video, this is also problematic for Europe as it stops buying Russian oil. The EU needs to make up 1.5 million barrels a day. Will they get it from the US at our expense or just from Iran and Venezuela? Whatever they decide, there will also be a supply problem for the EU.

The world faces serious problems on behalf of Ukraine.

Watch:

You can comment on the article after the ads (please be polite to commenters), and subscribe to the Daily Newsletter here if you would like a quick view of the articles of the day and any late news:

This is an interesting report on a solid plan to restrict Russia oil commerce. Western nations will of course bow down to their communist globalist masters to support this, to the detriment of their nations. We seem to be on the verge of the corrupt and communist west torpedoing oil tankers. I would not count on our military winning in… Read more »