Clients at Goldman Sachs are starting to worry about stagflation (subpar growth and elevated inflation) which hasn’t been a thing since the early 1980s, Axios reports.

If they’re worried, we should be as well.

“Stagflation” was the most common word in client conversations this week as equity market volatility remained elevated. … [T]his week the market focused on the risks posed to growth by supply chain challenges and rising energy costs.

One look at interest rates and energy prices should explain why, Zerohedge says.

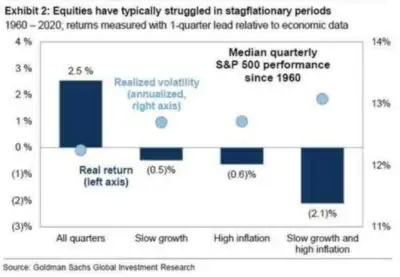

Goldman’s chief US equity strategist David Kostin admits that “the weak historical performance of equities in stagflationary environments helps explain why investors are concerned.”

During the last 60 years, Goldman calculates that the S&P 500 has generated a median real total return of +2.5% per quarter, but that quarterly return fell to -2.1% in stagflationary environments, worse than the median returns in environments characterized solely by weak economic growth or high inflation.

Stagflation made the 1970s a slog and ultimately brought the post-WWII global economic system to an end, Business Insider noted. It was the result of Jimmy Carter’s policies. Biden is Jimmy Carter on speed.

Everyone from investors to everyday consumers is desperate to avoid a repeat of the problem as coronavirus recedes.

People better hope Democrats don’t get to pass their $3.5 trillion socialist bill to fundamentally transform the nation.

Inflation has come in above 5% for the last three months in the US and jumped to a 13-year high in the eurozone in September. Central banks have spent most of the last year saying inflation should soon fade away, but the temporary inflation looks more permanent.

The US jobs market slowed dramatically in both August and September. Supply crunches have led to surging energy prices, causing some factories in China and Europe to stop production, reports Insider.

Only 124,000 jobs were added this year and 500,000 were anticipated. The unemployment numbers went down from 5.2% to 4.8% but that was because people simply left the workforce. The labor force participation rate went down from 61.7% to 61.6%.

Peter Schiff writes, “So, a weakening dollar with rising consumer prices, rising bond yields, and weak economic data – that spells stagflation. I mean, stagflation is here.”

We went from a booming economy to the manufactured crisis economy of Joe Biden and his comrades. Worse yet, he’s only just begun.

DOH! Socialism just doesn’t work in a capitalist system, imagine that. You’d have to be an Einstein level genius to figure that out. (not really) Those that aren’t too big to fail have to make that filthy lucre by any means necessary but commune collective sh1thippies from Vermont are economic illiterates without a clue or is it part of the… Read more »