The Real Financial Bubble Burst Two Years Ago

by David Reavill

Every major financial crisis is a result of excess. Today we recognize this phenomenon as mass psychology, the crowd’s actions as they take things to the extreme. For instance, we can see this out-of-control action at an auction when two bidders continue to battle each other far beyond the item’s fair value. We see it in the stock market every time a new “craze” hits. The “dot com” bubble of the last decade is a good example.

This mass psychology was first identified 180 years ago by Charles Mackay in his book: Extraordinary Popular Delusions and the Madness of Crowds. In this remarkable book, Mackay describes how a psychological fervor builds, and people seem unable to resist the temptation of taking the plunge. Sometimes literally speculating their entire life savings away, all to “hit it big.”

Today we call this type of financial behavior a “Bubble.” They can be nearly irresistible if caught up in a Bubble. I remember one particular “bubble” hit in Beverly Hills, West Los Angeles, in the early 1980s. If I recall correctly, this “Bubble” was named The Pyramid appropriately.

As described, it was a perfect definition of a Ponzi Scheme. Early gamblers put money in a pool. Funds from the new speculators paid off the earlier gamblers. So every month, members would be paid by those who joined.

The trouble with this kind of scheme is that eventually, they grow so large because they need more and more gamblers to join in. Ultimately, there aren’t enough new gamblers to support all the earlier gamblers, and the whole thing collapses. But not before those early gamblers get very rich. And as you’ve probably guessed, those late gamblers lose it all.

First conceived by Charles Ponzi in the nineteenth century, this has been the standard form of financial fraud ever since. The Ponzi Scheme was how Bernie Madoff operated his scam. A hoax that eventually reached an estimated $50 billion.

So there are two dimensions of a financial disaster. The Rubes believe they “can’t lose.” They’re all willing to accept anything and risk everything in their conviction that they’ve got a real winner.

The other dimension is the fraudster, the huckster. The one that convinces everyone that they are smarter than all the rest. That somehow, they “know better.” And because they are so upstanding, you don’t need to check; take their word for it. Madoff’s only auditor was his nephew, and he wasn’t telling.

Now, fraud can be challenging to catch. It takes hard work, impartial financial audits, and a thorough investigation. Bernie Madoff operated for years with a bit of suspicion. But in the end, he, like most frauds, was apprehended.

As for the “Madness of Crowds,” that mass psychology that makes up the other side of the Bubble can be even more challenging to determine. But there is one indicator that we can use. And that is the amount of money that people are borrowing. Financial leverage is a pretty good indication, not perfect, that conditions are suitable for a giant Bubble. Easy money, as they say, makes people gamble.

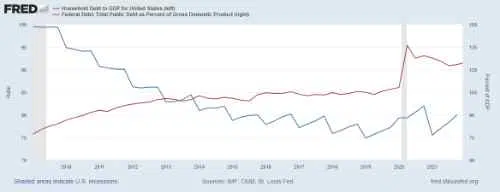

Since the last great “Bubble,” the Financial Crisis of 2008, the American people appear to be stepping away from the gambling frenzy. Compared to our overall economy, Americans are using 10% less leverage than they did then. In short, Americans are becoming more prudent. An excellent sign that if another “Bubble” does occur, it will not come from the average citizen.

But another player in our financial system is not prudent, and that would be the Federal Government. Back in 2008, it was individuals who were the most leveraged, having 25% more debt than the government. Today the federal government has much more financial obligation than the citizens, about 40% more. And nearly all of that increase came from their reaction to the Pandemic, increasing Washington’s debt by a third in less than two quarters.

Just the sort of wild, irrational spending you generally see when fraud is involved. This spending pattern alone is a sign that something is seriously wrong. The administration’s spending rate indicates a total disregard for the standard financial checks and balances. They must have side stepped financial controls; avoided internal audits, all to spend the money as fast as possible.

For those first few months in 2020, regular audit controls likely stood down. There was not enough time to spend that much money using proper requisition procedures and audit trails. Just let the money flow had to be the order of the day.

Now, when the financial Bubble bursts, it takes time before the full ramifications are recognized. The Stock Market Crash of 1929 was an immediate tragedy in and around New York, but it took years to work through the depression out in the country.

Bernie Madoff’s fraud took place over decades. And it took years more of forensic accounting before all of his “investors” realized the full extent of their loss.

The financial crisis we’re living in today occurred in those first few months of 2020. But stand by for the full effect.

Economic News

Another blow to the Supply Chain as Typhoon Muifa has a bull’s eye on the largest container port in the world, Shanghai, China. It is expected to make shore tomorrow, with waves as high as 16 feet. Muifa is a major Typhoon, and Chinese authorities are already closing facilities to minimize damage. Shanghai is the vital link between Chinese production and the West Coast ports of Los Angeles and Long Beach.

Were you wondering just how those Russian Sanctions are working out? Remember, the European Union and the United States slapped stiff sanctions on importing Russian Energy. The US cut off all oil and gas imports from Russia. Well, the Financial Times reports that Russia’s primary petroleum exporter, Gazprom doubled its revenue this year. That’s correct income went from $53 billion to $100 billion. It was primarily driven by the higher prices of oil and gas. And the reason for those higher prices? You guessed it: the sanctions.

The big news of the day, Inflation eased for the second month in a row. The widely watched CPI recorded an 8.3% increase for the month of August. This was slightly higher than Wall Street expected, but generally in line with the conventional reading of the economy. This sets up the Federal Reserve to raise interest rates by 3/4%, when they meet next Wednesday.

In earnings today, a couple of companies have already reported. Infrastructure company Core and Main is trading higher in the pre-market on their results. While Viavi Solutions is also trading higher, they are only guiding now.

The wheels came off the economy when the Government started printing worthless COVID Relief Dollars. Anytime the Government prints money in excess of the Nation’s production the Money is Worthless, drags down the value of money in circulation, and creates inflation. This isn’t rocket science. For the Gen-Z out there, when your dealer cuts your Cocaine with Caffeine it is… Read more »

I think the Biden administration sees inflation, not as the result of bad policy, but a panic over the fear of inflation and thus if they can make people there is no inflation it will stop. Thus Joe keeps saying, in the face of the facts, we have beat inflation. The problem is that the facts are becoming more and… Read more »