Can We Afford A Trillion Dollar Debt Payment?

by David Reavill

The Federal Reserve announced its latest decision on interest rates. The Fed raised rates once again. This brings the prevailing short-term rate to 5%. That means that all forms of Debt will continue to have higher interest payments.

This includes the massive Debt of the US Government. Today’s interest rate increase will likely mean that the Government’s interest rate payment this year will exceed $1 trillion for the first time in history.

It will come as no surprise that our Government has chalked up a tremendous amount of Debt. Recently the amount of Debt we’ve added has grown astronomically. The Covid-19 Pandemic, and the subsequent economic lockdown, added about 20% to the Federal Government’s debt load. Currently, the National Debt stands at more than $31 Trillion, or about $14,000 for every man, woman, and child in the country.

Interest on the Debt continues to expand. It is now the fourth largest expenditure by Washington. Three expenses are greater: Medicare, Social Security, and Defense. And at the rate we’re going, the interest on the Federal Debt will pass Defense spending in just a couple of years.

The interesting thing about the other major government expenditures is that they are non-discretionary. Indeed, Medicare and Social Security benefits are set by statute so that they won’t change. And as a practical matter, Defense spending is also established and unlikely to see any significant changes.

But as to the interest expense for the Federal Debt, that’s a different matter altogether. If Wall Street is accurate in its prediction, there will be a new Federal Debt interest rate later this afternoon. At 2 pm Eastern Time, the Federal Reserve will set a new short-term interest rate. The Street thinks the new rate will be 5%, or a quarter percent higher than the current rate. This will immediately drive the interest on Treasury Bills and Short Term Notes.

The US Treasury will have to dig deeper in its pocket to come up with more to make those interest payments. Well, perhaps it’s more than just a “little.” The current annual interest payment on US Debt is nearly half a trillion. And with the Fed bumping interest rates today, that should increase our country’s annual interest payment to better than $Trillion by the end of this year. As they say in rural Pennsylvania, “that ain’t chicken feed.”

The Federal Government’s interest expense is now so considerable that it’s impacting the economy. If the Federal Reserve sticks to its projected interest rate increases, then interest on the “Govi” Debt could be near 2% of the nation’s GDP quickly. It’s like a one-two punch by the Federal Reserve. First comes the jab, the increase in the overall interest rate, but the roundhouse follows the multi-billion dollar added Govi interest expense.

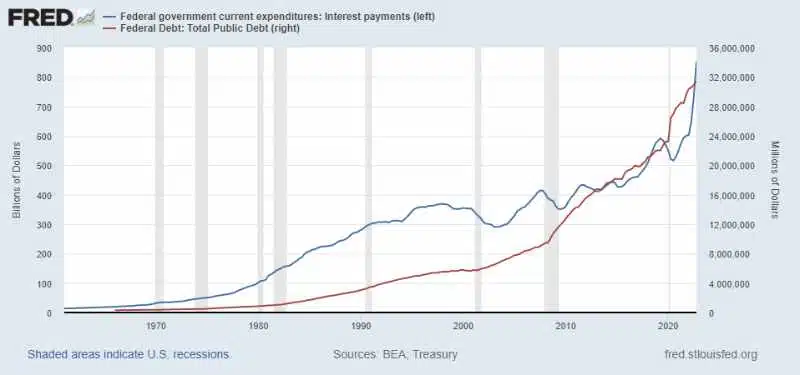

I’ve included a chart showing just how this works. The red line on the chart shows the total Public or Government Debt. As you know, public Debt keeps growing and growing. A little faster recently because of the Pandemic, but overall relentlessly.

The blue line represents the interest expense on that Debt. Real dollars are taken from the nation’s income to pay for current and past government expenditures. Notice that the blue line, interest, does not follow the red line, Debt. The “interest” line is all over the place. At times, like back in the 1970s through the early 2000s, the blue line is well above the red line. That was a time of high interest when interest expense accelerated far faster than Debt.

But then, at that gray bar in 2008, interest expenses began to fall. This was precisely when the Federal Reserve dropped interest rates to essentially zero. But notice what happened last year. The Federal Reserve started to march interest rates higher. And the blue line, the interest expenses, has gone vertical. The $1 trillion interest expense on Govi Debt is already in sight, and we will make that unfortunate target shortly, certainly by the end of 2023.

I remember back in 2008 when the Federal Reserve first announced its program of Quantitative Easing. This was like one of those low-interest rate bank transfers, an opportunity for this country to pay off, or at least pay down, our Nation’s Debt. Unfortunately, it didn’t work out that way. Instead, we find ourselves deeper in Debt, with an interest payment nearing a trillion dollars per year.

So at 2:30 this afternoon, when Fed Chairman Jerome Powell starts his press conference, I wish just one reporter would ask, what will these new higher interest rates do to the nation’s economy? After all, a trillion-dollar Govi Debt payment will exert quite a dampening effect.

As long as we keep our nukes, no one will be able to force us to repay anything. That’s absolutely criminal, but that’s all Washington has left us with.

Can we afford a trillion dollar a year interest payments to the oligarchs? The oligarchs don’t care. If they have capital to invest in our federal debt, they will instruct their politicians to raise the debt to the amount of money they are willing to invest. If we have to sell our assets to pay the taxes and deal with… Read more »

The Oligarchs don’t want to move use to slave plantations in the cities. The want us dead! The World Economic Forum Cult has been very vocal about this plan!

Assuming 330 million population, the debt per person is some $94,000!!…..not the $14,000 noted early in the above. There is no escaping the economic catastrophe our ruling political and financial class has created for us. And the ultimate implosion may well be underway right now……..

I think what the piece was trying to say is the Interest Cost this year alone will be $1400 per person. That means a cost of $5600 per family. Right now, a Family of 4 in the lower 50% of taxpayers doesn’t even pay $5600 in taxes a year. Basically, there are a lot of deadbeats in America and if… Read more »

If discretionary spending is not cut by 75% this year, the Dollar will crash in under 4 years. The Debt Ceiling must not be raised and wee need to pay down the Debt Principle at a rate of 1 Trillion Dollars a year for the next 30 years.

Of course not, but we could surely afford to pay a couple hitmen to eliminate those crooks.

To put things into perspective,

1,000,000 seconds (1 million) seconds is 11.57 days

1,000,000,000 seconds (1 billion) seconds is 31.71 years

1,000,000,000,000 seconds (1 trillion) is 31,709.79 years

Cancel the debt.