Residential electricity rates have been surging for months and are poised to climb even higher this summer on a combination of tight supplies of natural gas and coal [thanks to Biden], an unrelenting drought in the Western US, and a nationwide forecast for extreme heat, according to Bloomberg.

Barclays Plc calculates that monthly bills will be more than 40% higher than last year’s, and projections from the US Energy Information Administration show this year’s retail residential rates rising the most since 2008.

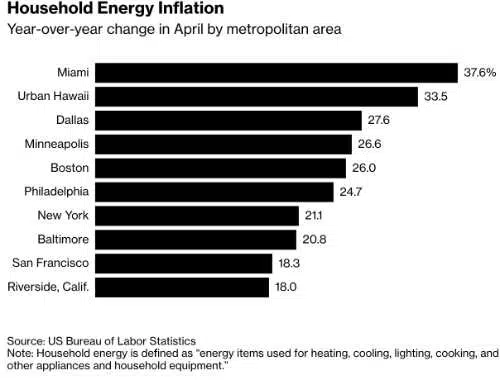

Check out the increases:

US residential power bills averaged $122 a month last year, but with natural gas prices above $8 per million British thermal units, that figure could rise by $49, according to Barclays analyst Srinjoy Banerjee. A year ago, gas cost less than $3.

The burden “disproportionately falls on lower-income groups,” Banerjee says.

Higher bills are a significant issue for older people living on fixed incomes, says Cristina Martin Firvida of the AARP. Many are concerned not only about rising costs but also about having their power shut off if they can’t afford to pay their bills. “We have seen some really tragic and deadly outcomes,” she says.

She calls it a “perfect storm”.

Refining capacity has shrunk dramatically since 2020 due to the mishandled covid pandemic and lockdowns, driving fears of a supply crisis, and prices climb.

RECESSION AKA DEPRESSION

It is looking increasingly likely that the only cure for these high prices would be a recession, a devastating cure.

U.S. gasoline and diesel prices are soaring to record highs nearly every day, as crude oil prices hold above $110 a barrel, the Russian invasion of Ukraine and US sanctions upend global crude and refined product trade flows, and refinery capacity globally is now lower than before the pandemic after some refineries—including in the United States—closed permanently after COVID crippled fuel demand in early 2020. The closed refineries are due to Biden’s lockdowns during COVID.

People never seem to mention that we aren’t building new refineries, at least not in the US. – Columbia, sure, but not here.

There is no quick fix for the prices continuing to climb analysts say. The quickest fix is actually not one American consumer would want — a recession that would lead to job losses.

Recession is a nice word for depression.

THE REFINERY DISASTER

Bloomberg’s Blas notes the drop in inventories with refineries operating at over 94%.

The fact that the US saw a drop in gasoline inventories (and a minimal build up in diesel stocks) despite unusually high refinery utilization rates in May is quite concerning #OOTT

— Javier Blas (@JavierBlas) May 25, 2022

OIL MARKET: US total crude and refined products gross **exports** are on fire, surging above 10.5 million b/d for the 2nd only weekly period ever. The US is truly the barrel of oil of last resort of the global economy | #OOTT

— Javier Blas (@JavierBlas) May 25, 2022

Biden’s exports to Europe are driving up prices. We exported over 74 million barrels of oil and products last week. That included more than 30 million barrels a day of crude. The crude number isn’t unprecedented but two previously higher numbers occurred in the ultra-cheap year of 2020, says Tom Cloza. We export as prices climb.

We were lucky last winter, but with rising fuel cost people are going to freeze to death in the coming Winter.