“The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.”

― George Orwell, 1984

Update: The Feds just announced that they expect a mild recession. The Consumer Price Index marks the 23rd straight month inflation has been at or above 5%, and the 24th straight month of negative real wages. This has been a real-wages recession for workers.

Layoffs are coming, we’re losing the dollar reserve status, and the dollar is losing its value as prices increase. We have more people dropping out of the workforce, but Janet Yellen says we’re doing great.

According to a report released by the IMF Tuesday, the U.S. economy is projected to grow just 1.6% this year and 1.1% next year, a slight improvement from the IMF’s projections in January. However, those estimates represent a decline from the 2.1% growth the U.S. experienced last year, according to the IMF. We’re running a $1.7 trillion deficit this year and run these huge deficits every year. Our debt is approaching $32 trillion, but it’s all good. Just ask Janet Yellen. Watch the clip at the end.

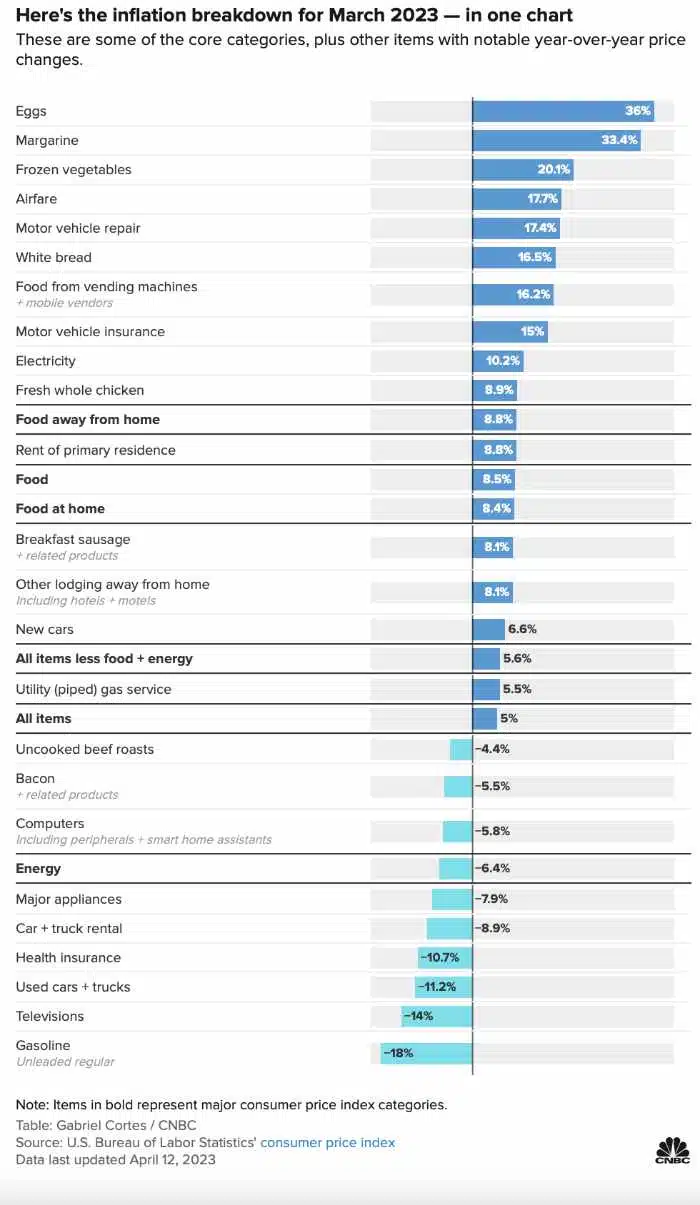

Inflation was up another 5% last month, and that is being lauded as a good thing. The media likes to say it “eased” to 5%. That’s 5% on top of the inflation we already have. It keeps going up. The MSM also wants you to know that it’s the lowest it has been in two years. Notice the two years cover Joe Biden’s term in office to date.

The government has a new way of recording inflation for the Consumer Price Index. Core inflation is higher.

Core inflation EXCLUDES FOOD AND FUEL PRICES and rose to 5.6% in February. That figure, which some view as a better indicator of underlying price pressures, has changed little since December, CBS notes. Transportation, electricity, food, and shelter were the biggest contributors to last month’s price increases.

Food and fuel are down, but down from what? They’re down from Biden’s high.

The price of energy is based on Biden’s high, not Trump’s low.

We also have the little problem of Biden alienating the world and, as a result, there is a global movement to end the dollar as the reserve currency. Since we rely on the world for our manufacturing, and we have tremendous debt, we are in a bad position. We won’t be able to print money any longer, but the drunken sailors who run our government will keep spending.

We borrow $6 billion a day to survive from people who hate us. If we can’t print money, that number goes up.

Speaking of drunken sailors, have you heard Janet Yellen’s latest crazy talk?

“The economy is obviously performing exceptionally well…,” says Yellen with her make-believe economics.

To be fair, it’s amazing the economy isn’t completely destroyed yet.

Watch:

You can’t make this up.

Treasury sec. Janet Yellen: The US economy is obviously performing exceptionally well.

— Kambree (@KamVTV) April 11, 2023

If your not buying gold you will look back in the very near future and wonder how is it possible that you didn’t see the collapse of the USD coming.

Yeah, and she said inflation was transitory.

“Economy Is Performing Exceptionally Well”Give Yellen her due. It is performing exceptionally well considering that the Democrats (Yellen and her ilk) have done everything conceivable to destroy the economy and most of us still have a little “over-priced by Biden inflation” food on our tables,

Janet Yellen is a Moron. Every indicator says the Economy is crashing and we will be in a Full Blown Depression, Worldwide in under 2 Years. It all started with Traitor Joe’s War on Energy! If the Government looked at overall buying Power, we would see that it is down over 30% in since Traitor Joe took Office and Rising!

Note than in January 2021 an Average House note was $1427 and Today it’s $2430. The single most costly thing, Shelter, now cost 70% more while the Government is trying to telling us it’s up only 8.8%. Gasoline is up 87% in my area over the same period. Many people I come across are having to dive into their retirement… Read more »

Anyone who held onto a variable rate mortgage when interest rates were under 3% is a complete moron.

They need to keep residential housing prices high or banks go bust. You might be paying more for essentials, but big ticket debts can remain at current levels. Property taxes & consumer taxes continue at current volumes so entitlements get paid. Few can afford groceries, but at least it’s still worth paying the mortgage every month…until it isn’t.

Everything is being manipulated to increase the power and wealth of the elite.

They want us to count our inflation inflated assets without realising we actually have far less real value. The way it is going pan-handlers on the streets will be worth millions.