Fox Business reports that an inflation measure closely watched by the Federal Reserve rose faster than expected in January.

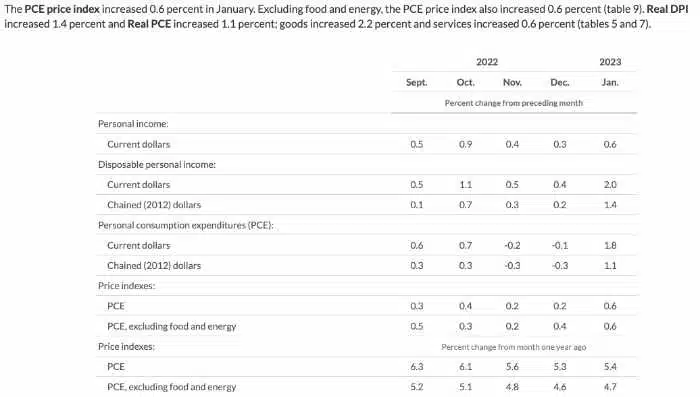

“The personal consumption expenditures (PCE) index showed that consumer prices rose 0.6% from the previous month — the most since June — and accelerated 5.4% annually, according to the Bureau of Labor Statistics.

“Food prices increased 0.4 percent, and energy prices increased 2.0 percent. The PCE price index increased by 0.6 percent, excluding food and energy.

BEA reports, “Government social benefits decreased in January, reflecting a decrease in “other” benefits that was partly offset by an increase in Social Security. The decrease in “other” benefits primarily reflected the expiration of the extended child tax credit (as authorized by the American Rescue Plan) as well as a decline in one-time refundable tax credits issued by states. ”

Inflation rages in services. On a year-over-year basis, the PCE Price Index for services spiked by 5.6%, the worst since 1984. And I bet it’s still underreported 🚨 pic.twitter.com/tOjwIX9AJo

— Wall Street Silver (@WallStreetSilv) February 24, 2023

“Core inflation in January was hotter than expected, all but insuring the Fed will continue on its rate hiking campaign for a lot longer than markets anticipated just a few weeks ago,” said Jeffrey Roach, chief economist at LPL Financial.

The market went down 300 points upon the news.

1/5

Uh oh, Powell’ new (invented) metric of “Core PCE services less Housing Services” soared in January to 0.58%.

As this chart shows, this is one of the highest readings ever.

Powell says this metric is 55% of core inflation. And it is highly sensitive to wage and labor. pic.twitter.com/rEuRSFgi9V

— Jim Bianco biancoresearch.eth (@biancoresearch) February 24, 2023

The middle class and lower get hit again. How will pensioners get on now;