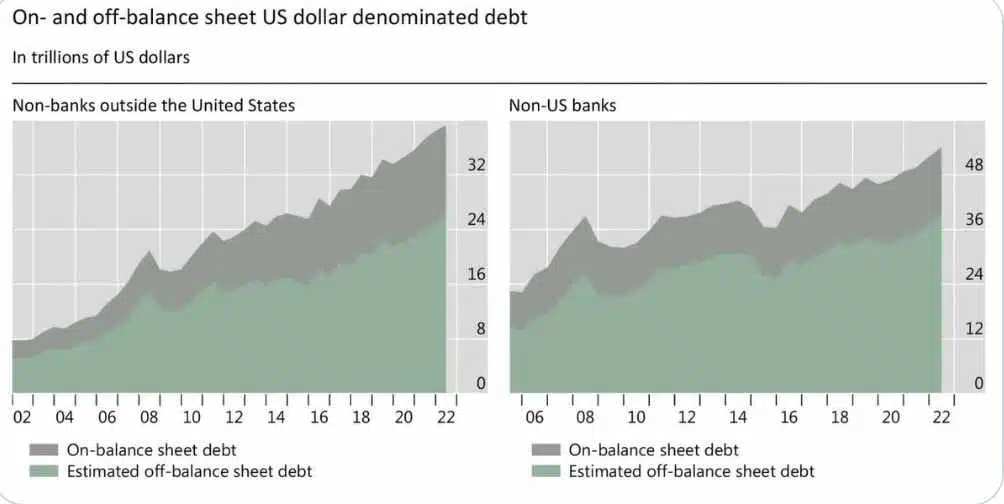

The Bank for International Settlements (BIS) has warned that pension funds and other ‘non-bank’ financial firms now have more than $80 trillion of hidden, off-balance sheet dollar debt in the form of FX swaps… 🔥🔥🔥

Probably nothing. ~ Wall Street Silver

FX swap debt markets are putting us in grave danger of a colossal crash, potentially equaling none before. It could wipe out every dollar in the world. But as Wall Street Silver says, “probably nothing.” We wouldn’t want to be accused of spreading conspiracy theories.

The globalist bank, BIS, The Bank for International Settlements, is extremely prestigious. It is the central bank’s bank. They tell us trillions of dollars are borrowed and lent in various currencies. Deals take place in cash through loans and securities. Then there is the foreign exchange (FX) derivatives or swaps. They create debt-like obligations. For the US dollar alone, contracts worth tens of trillions, perhaps 80 trillion, are open and change hands daily.

[They’re something like Pyramid Schemes or bad credit card debt. They include pension funds and other non-bank financial institutions.]

You won’t find them on the balance sheets. They are MISSING, and we know little about them.

The Bank for International Settlements (BIS) has warned that pension funds and other ‘non-bank’ financial firms now have more than $80 trillion of hidden, off-balance sheet dollar debt in the form of FX swaps. ~ Willem Middelkoop

Every day, trillions of dollars are borrowed and lent in various currencies. Many deals take place in the cash market through loans and securities. But foreign exchange (FX) derivatives, mainly FX swaps, currency swaps, and closely related forwards, also create debt-like obligations. For the US dollar alone, contracts worth tens of trillions of dollars stand open, and trillions change hands daily. And yet one cannot find these amounts on balance sheets. This debt is, in effect, missing.

There are 80 trillion dollars at stake in this potential crash. The terrible crash of Lehman Brothers in 2008 was only $619 billion.

THE THREAT OF FX

FX is the threat; we know little about its workings and have little control.

Reuters reports that pension funds and other “non-bank” financial firms have more than $80 trillion of hidden, off-balance sheet dollar debt in FX swaps.

BIS described the FX swap debt market as a “blind spot” that risks leaving policymakers in a total “fog,” the latest BIS quarterly report said.

A Dutch pension fund or Japanese insurer could use borrow dollars and then lend them as euros or Japanese yen before later repaying them.

Off-balance sheet dollar debt may remain out of sight and out of mind, but only until the next time dollar funding liquidity is squeezed. Then, the hidden leverage and maturity mismatch in pension funds’ and insurance companies’ portfolios – generally supposed to be long-only – could pose a policy challenge. And policies to restore the flow of dollars would still be set in a fog. ~ BIS

Reuters says the FX swap market has a history of problems in financial crises and during the pandemic.

Swap deals total a massive $5 trillion a day, reports Reuters.

Non-US banks and pension funds have twice as many FX swap dollar obligations as the dollar debt listed on their balance sheets.

“The missing dollar debt from FX swaps/forwards and currency swaps is huge,” BIS said.

Yet nobody knows where this debt is and how much it is worth.

The world would be helpless in the face of a meltdown on this scale, yet nobody has any control over the market.

The next financial crisis threatens to be even bigger than the last one.

Obviously most people haven’t figured out that Fiat Currency backed by a “political promise” can collapse overnight.