by David Reavill

By now, we’re all familiar with Silicon Valley and Signature Bank. Both banks closed in March. We were told their failure was due to poor management and risky business practices. Signature Bank was involved with Private Equity Funds and Commercial Real Estate, while Silicon Valley Bank focused on high-net-worth individuals in the Technology Industry. Moreover, both banks had a substantial number of customers active in Crypto, which neither the Fed nor Treasury supports, especially now, as the Fed and Treasury prepare to launch their own Central Bank Digital Currency (CBDC).

At least, that is how the regulators described their businesses, and they left it to us to conclude that those kinds of customers must have been very high risk. The two banks became a convenient scapegoat for the current ills in the banking industry.

Investors and savers get nervous whenever a bank goes out of business. In the days following the two banks’ failures, there were rumors of bank runs as worried customers took their money out. Is our savings or checking accounts still safe?

But, “Not to worry,” said Washington, just two bad banks went out; everything is hunky dory now. By and large, that’s all it took. Most bank customers were appeased, and things seemed to return to normal. However, Wall Street remained skeptical and dropped the price of several other regional banks with the same profile as Silicon Valley and Signature.

But what if there is much more to our story than two high-risk banks being closed? What if the seeds for today’s troubles began many years ago, and we still need to address the problem fully?

This part of our story began 21 years ago, in 2002 when a little-known Economics Professor spoke before the Federal Reserve Bank of San Francisco. His name was Ben Bernanke, and his speech made headlines as he called for a “helicopter drop” of money to rescue the economy should a significant depression, like the 1930s, hit again.

I distinctly remember the ridicule “Helicopter Ben” took for those remarks. Most of us on Wall Street assumed that Bernanke had torpedoed any chance he might have had in Washington. We couldn’t have been more wrong. Just four years later, Bernanke became the Chairman of the Federal Reserve, arguably one of the two most important economic positions in Washington. The other is the Secretary of the Treasury.

The helicopter speech put the world on notice that Chairman Bernanke would go to extraordinary lengths to prop up the economy should things turn south. Less than a year after taking over the Fed, Bernanke dropped interest rates from 5 1/4% to zero. And we’ve been stuck there ever since.

The Federal Reserve tried to raise interest rates above the Zero bound level thrice, and each time they failed. The reason for those failures is straightforward, so much of our financial system now depends on debt. And each time the Fed tried to raise interest rates, the overhanging debt levels forced them to reverse back to zero.

The US Federal Government is the biggest debtor, followed by various agencies and state and municipal governments. Everyone carries a substantial amount of debt, and each time the Federal Reserve raises interest rates, they make our life a little more complicated, as now we have to pay an increase in credit cards, home loans, and various other types of consumer debt. Corporations have also taken on debt like it was going out of style, as have ordinary American citizens like you and me.

But for today’s story, it is the banks, most of all, who must live on that razor-thin margin between their cost of funds and their interest income. Raise a bank’s cost of funds, and you immediately begin squeezing their revenue. Raise interest rates enough, and the bank will fail, just like Signature and Silicon Valley Banks.

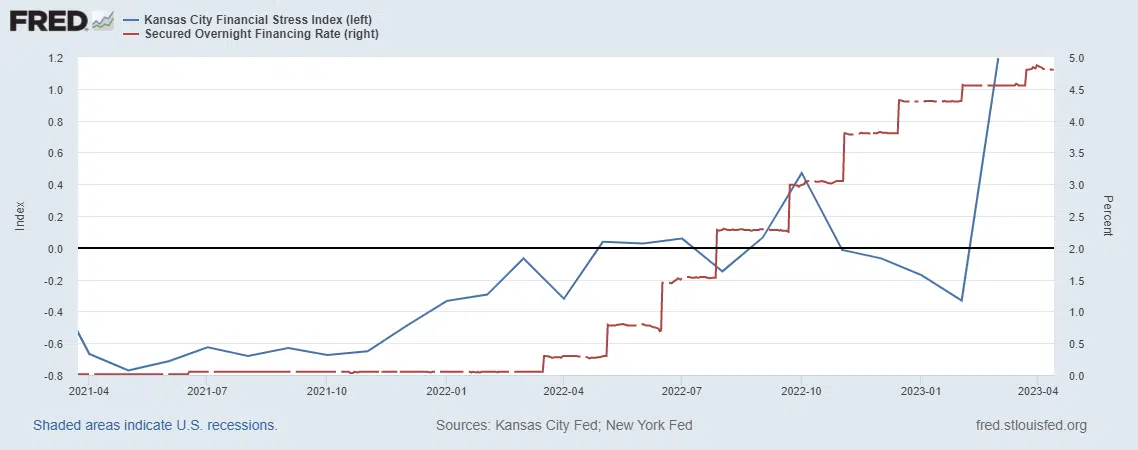

The enclosed chart shows the current cost of funds for Banks (The Secured Overnight Financing Rate) and the Fed’s Financial Stress Index. Interest Rates and Financial Stress are rising is not a good thing. And judging from the amount of stress impacting the financial system, it is reasonable to assume that more banks may find themselves in trouble.

Regulators will shut down any financial institution that fails to meet minimum capital requirements. I’m OK with that. I’ve been in the Financial Services Industry long enough to know you’re done once you violate your capital requirements. I am not suggesting that either Silicon Valley or Signature Bank should have been allowed to continue operations.

I am saying that the current dramatic rate of increase in interest rates is creating an intolerable situation for many financial institutions, especially those like commercial banks, which live on the spread between cost and income.

These accelerated interest rate hikes are inflicting tremendous pain on the economy. This Fed overlooked the reasons behind the past Fed’s failures in hiking rates. For 15 years, the Fed lived in a world with zero interest rates. And then, because of their overreaction to inflation, the Fed has precipitously jumped interest rates. It is their rate of increase that’s at issue here. A more gradual interest increase would allow banks to adjust. But this Fed seems determined to “cure” inflation instantly, and that is harming banks and other financial institutions.

While it’s true that the Fed may kill inflation with this strategy, we’re also likely to see a few more dead banks along the way.

We are all in a boat surrounded by water. Water is debt. The boat is money. The boat is filling with water, but people are partying like it’s a hottub. Some people have a life raft, or a jet ski they can escape on. Most don’t. The boat is so full, only the rim is visible above the water. This… Read more »

The America Banking system is in Trouble because the System is a Ponzi Scheme, Built on a House of Cards, on a Ship that is adrift in a Storm. The system was devised by the Ultra-Rich to allow them to manipulate Markets, get even richer, and leave Taxpayers holding the Bag when the System collapses.