According to the Mortgage Bankers Association, higher interest rates and high home prices dragged down the demand for mortgages for the third week. It is possible the housing market will collapse.

The MBA said that mortgage applications fell 6.3 percent for the week ending July 15, 2022.

For the week, mortgage applications to purchase a home dropped 7 percent. Compared with a year ago, applications are down 19 percent.

Refinance loans continued to fall. The refinance index fell four percent from the previous week and is 80 percent lower than a year ago.

The Federal Reserve is going to sacrifice the housing market to try and curb inflation.

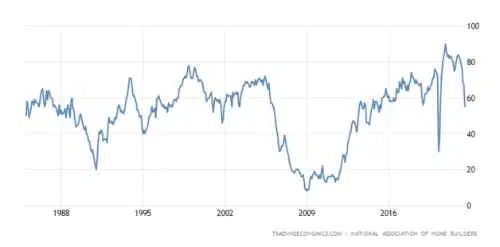

HOUSING RECESSION

Logan Mohtashami says the headline numbers on today’s housing starts data looks OK, but the reality is different. That reality can be seen more clearly by looking at the homebuilder’s sentiment index, which collapsed yesterday. Nothing will change until interest rates go lower.

Mr. Mohtashami is the Lead Analyst for HousingWire, a housing data analyst, financial writer, and blogger covering the U.S. economy.

AFFORDABILITY GAP

Back in May, before interest rates increased, Home.LLC reported that the median-priced home costs $425K, while the median American can only afford a $373K home. This affordability gap of $52K is the highest on record. Millions of Americans are facing an affordability crisis.

Mostly, Nik Shah – of Home.LLC – sees the housing market decelerating, but some states will crash. The lowest demand for homes is in LA, San Francisco, and New York City.

They are also losing residents. 361,000 people migrated out of NYC last year, while LA lost nearly 200K residents!

He believes the riskiest home markets are in Florida, Texas, Utah, and Boise, Idaho. Of the top ten riskiest cities, four are located in Florida, three in Texas, two in Utah, and one in Idaho. They all have reduced demand and rapidly increasing supply.

“I HOPE IT DOESN’T CRASH”

Stephen Moore, a former Trump economic adviser, is very concerned about a housing crash.

“That’s a big concern of mine,” Moore said in an interview with Kitco News. “I’m really nervous about the housing market. We’ve had a red-hot housing market now for five or six years.”

Moore, who served as Donald Trump‘s senior economic advisor during his presidency, said he “prays” the U.S. is not facing a housing bubble, “because remember when that bubble burst [in 2008], the whole economy collapsed.”

“Mortgage rates were 3 percent a year and a half ago, now they’re creeping up to about 6 percent. Just that alone means that if you buy a $500,000 house and your payment on a 30-year mortgage goes up by $200,000. So it is going to pinch the housing market. I hope it doesn’t collapse it,” Moore said.

All the homes that are mortgaged could be facing foreclosure. The government owns most of the mortgages. They’ll be in charge of what happens next…FJB!

The housing collaspe is by design so BlackRock and the Chinese can buy up property at 20 cents on the Dollar. Remember what Charles Schwab told us, “You will have nothing and like it!”

Pretty sure you mean KLAUS Schwab (of Germany, who is the head of the World Economic Forum / WEF, and whose sole purpose is to destroy the West and bring us all into the subjugation of slavery), not CHARLES Schwab (who was the founder of the brokerage firm Charles Schwab & Co., Inc., which opened in 1975 when the SEC… Read more »

Joe Biden says, “I did that”.