Jason Furman, a Professor of Practice at Harvard and the former head of Barack Obama’s council of economic advisers, wrote on Twitter that “Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless. Doing it while going well beyond one campaign promise ($10K of student loan relief) and breaking another (all proposals paid for) is even worse.”

Prof. Furman pointed to the errors in the White House fact sheet.

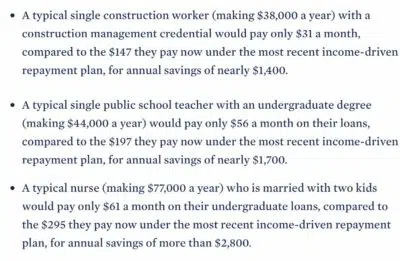

Furman writes, “The White House fact sheet has sympathetic examples about a construction worker making $38K and a married nurse making $77,000 a year. But then why design a policy that would provide up to $40,000 to a married couple making $249,000? Why include law and business school students?”

[To buy their votes?]

Furman pointed out that the basis used for the bill’s claim it won’t raise inflation is bogus. They used one baseline to describe the benefits and a totally different one to describe the benefits. It’s convenient and “indefensible.”

Furman continues, saying, “BTW, those examples also contradict the baseline some have concocted to claim that this won’t raise inflation. The claim it won’t raise inflation is based on the construction worker going from permanently paying $0 interest to paying $31 a month at an annual cost of $372.”

“You can’t use one baseline (interest payments suspended) to argue this will constrain demand & then a different baseline (interest payments restored) to describe the benefits. “That is incoherent, inconsistent & indefensible cherry picking–I hope the White House doesn’t do it.”

The bill also ignores future earning power.

“Also need to be careful with all of the distributional numbers because the beneficiaries will tend to have higher lifetime incomes than current incomes. A 24 year-old making $75,000 is likely to be at a relatively high percentile on a lifetime basis.”

The core problem of colleges raising tuition, encouraging students to borrow what they can’t afford is exacerbated by this bill. It encourages more of this bad policy.

“There are a number of other highly problematic impacts including encouraging higher tuition in the future, encouraging more borrowing, creating expectations of future debt forgiveness, and more.”

“Most importantly, everyone else will pay for this either in the form of higher inflation or in higher taxes or lower benefits in the future. I did a thread on this last night but given the new announcement you need to double everything in it.”

Increased deficits – unpaid for spending – will result in higher taxes or lower spending in the future.

“Increased deficits today mean higher taxes or lower spending in the future. No matter what you think of our fiscal course this is true–even if you think we have lots of fiscal space it would still mean forgoing spending increases or tax cuts.”

The US has been doing it for decades.

This bill squeezes the middle class. It’s not paid for by the colleges. It does in fact encourage colleges to keep going with their profligate ways. Doling out easy money so they can raise tuition is degenerating. Colleges should lower tuitions with their enormous endowments.

With this bill, money is redistributed from one group to put enormous pressure on another group within the middle class. People who didn’t go to college will pay for those who did go to college and will likely make a lot more money in their lifetimes. This doesn’t help anyone in the long run.

One group might – might – have more money to spend while another group will be penalized and reduce consumption more. This causes inflation.

Furman sees one thing likely happening. He sees total output unchanged and the mechanism to reduce consumption for other groups will be inflation.

“In the current high inflation circumstances it is also very unlikely that total output will rise by as much as the increase in consumption by the beneficiaries (now and in the future). So consumption will fall for others.

“In fact, if I had to use a modeling assumption I would assume that total output would be unchanged so the rise in the consumption for one group would be matched by equal declines in consumption for other groups. That’s likely close to correct right now.

“What is the mechanism that reduces consumption for other groups? The immediate one is inflation–the transfer recipients purchase more, drives up prices & so others can afford less.”

This is a lose-lose in the end.

You can comment on the article after the ads (please be polite to commenters), and subscribe to the Daily Newsletter here if you would like a quick view of the articles of the day and any late news:

This will result in no Student Loans in the future!

Taxpayers that couldn’t afford to attend college will also end up paying for ‘more’ Democrat votes.